Page 14 - LatAmOil Week 37

P. 14

LatAmOil SURINAME LatAmOil

But it did say it had been able to collect reser-

voir and technical data from the interval before

encountering problems during drilling.

Those problems, it explained, stemmed from

higher pressure levels below the base of the San-

tonian interval. “The company was able to suc-

cessfully retrieve rotary sidewall cores but was

unable to collect representative fluid samples

from the reservoir, [owing] to conditions caused

by cementing operations, which were required

to mitigate increased pressure below the base of

the Santonian formation,” it said in its statement.

Apache used the Noble Sam Croft drillship

to sink Kwaskwasi-1, the third exploration

well drilled at Block 58. The company has now

moved the vessel to the site of the fourth well,

which will be known as Keskesi East-1. The new

well, which will also test the Campanian and

Santonian intervals, will be sunk at a position

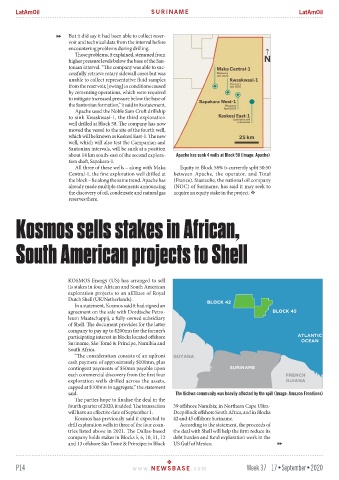

about 14 km south-east of the second explora- Apache has sunk 4 wells at Block 58 (Image: Apache)

tion shaft, Sapakara-1.

All three of these wells – along with Maka Equity in Block 58% is currently split 50:50

Central-1, the first exploration well drilled at between Apache, the operator, and Total

the block – lie along the same trend. Apache has (France). Staatsolie, the national oil company

already made multiple statements announcing (NOC) of Suriname, has said it may seek to

the discovery of oil, condensate and natural gas acquire an equity stake in the project.

reserves there.

Kosmos sells stakes in African,

South American projects to Shell

KOSMOS Energy (US) has arranged to sell

its stakes in four African and South American

exploration projects to an affiliate of Royal

Dutch Shell (UK/Netherlands).

In a statement, Kosmos said it had signed an

agreement on the sale with Dordtsche Petro-

leum Maatschappij, a fully-owned subsidiary

of Shell. The document provides for the latter

company to pay up to $200mn for the former’s

participating interest in blocks located offshore

Suriname, São Tomé & Príncipe, Namibia and

South Africa.

“The consideration consists of an upfront

cash payment of approximately $100mn, plus

contingent payments of $50mn payable upon

each commercial discovery from the first four

exploration wells drilled across the assets,

capped at $100mn in aggregate,” the statement

said. The Kichwa community was heavily affected by the spill (Image: Amazon Frontlines)

The parties hope to finalise the deal in the

fourth quarter of 2020, it added. The transaction 39 offshore Namibia; in Northern Cape Ultra-

will have an effective date of September 1. Deep Block offshore South Africa, and in Blocks

Kosmos has previously said it expected to 42 and 45 offshore Suriname.

drill exploration wells in three of the four coun- According to the statement, the proceeds of

tries listed above in 2021. The Dallas-based the deal with Shell will help the firm reduce its

company holds stakes in Blocks 5, 6, 10, 11, 12 debt burden and fund exploration work in the

and 13 offshore São Tomé & Príncipe; in Block US Gulf of Mexico.

P14 www. NEWSBASE .com Week 37 17•September•2020