Page 82 - bneIntelliNews monthly country report Russia May 2024

P. 82

,000

,000

,000

,000

,000

,000

,000

,000

,000

,000

,000

000

,000

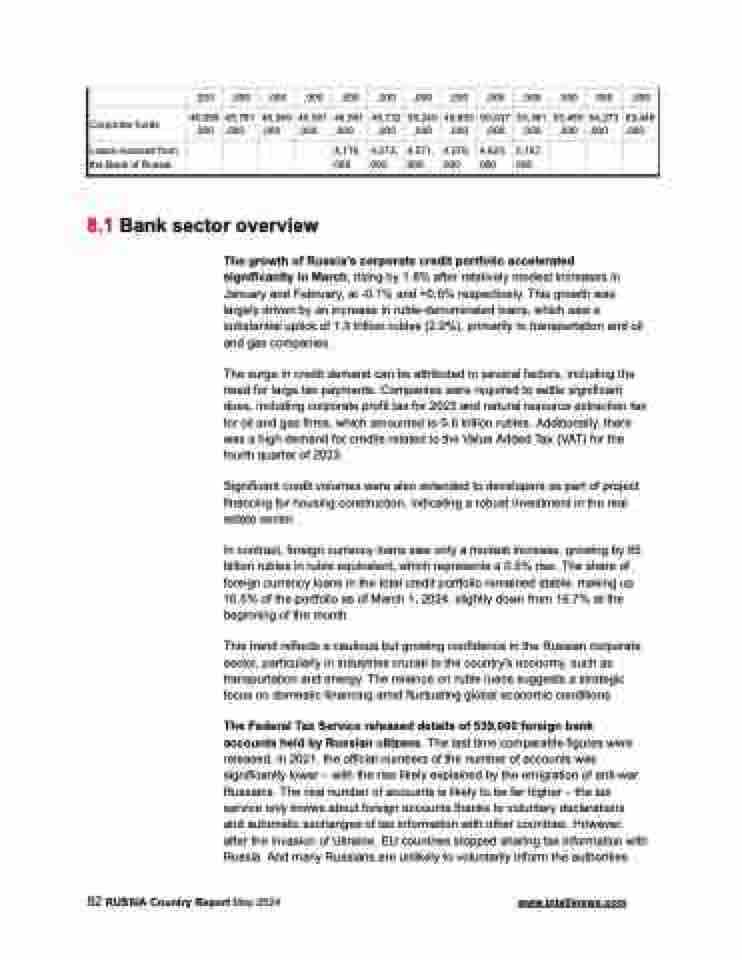

Corporate funds

46,089 ,000

45,781 ,000

46,349 ,000

46,581 ,000

46,581 ,000

49,732 ,000

50,240 ,000

49,855 ,000

50,637 ,000

53,381 ,000

53,465 ,000

54,273 ,000

53,448 ,000

Loans received from the Bank of Russia

4,176, 000

4,273, 000

4,571, 000

4,276, 000

4,620, 000

5,167, 000

8.1 Bank sector overview

The growth of Russia's corporate credit portfolio accelerated significantly in March, rising by 1.8% after relatively modest increases in January and February, at -0.1% and +0.6% respectively. This growth was largely driven by an increase in ruble-denominated loans, which saw a substantial uptick of 1.3 trillion rubles (2.0%), primarily to transportation and oil and gas companies.

The surge in credit demand can be attributed to several factors, including the need for large tax payments. Companies were required to settle significant dues, including corporate profit tax for 2023 and natural resource extraction tax for oil and gas firms, which amounted to 0.6 trillion rubles. Additionally, there was a high demand for credits related to the Value Added Tax (VAT) for the fourth quarter of 2023.

Significant credit volumes were also extended to developers as part of project financing for housing construction, indicating a robust investment in the real estate sector.

In contrast, foreign currency loans saw only a modest increase, growing by 65 billion rubles in ruble equivalent, which represents a 0.5% rise. The share of foreign currency loans in the total credit portfolio remained stable, making up 16.5% of the portfolio as of March 1, 2024, slightly down from 16.7% at the beginning of the month.

This trend reflects a cautious but growing confidence in the Russian corporate sector, particularly in industries crucial to the country's economy, such as transportation and energy. The reliance on ruble loans suggests a strategic focus on domestic financing amid fluctuating global economic conditions.

The Federal Tax Service released details of 539,000 foreign bank accounts held by Russian citizens. The last time comparable figures were released, in 2021, the official numbers of the number of accounts was significantly lower – with the rise likely explained by the emigration of anti-war Russians. The real number of accounts is likely to be far higher – the tax service only knows about foreign accounts thanks to voluntary declarations and automatic exchanges of tax information with other countries. However, after the invasion of Ukraine, EU countries stopped sharing tax information with Russia. And many Russians are unlikely to voluntarily inform the authorities

82 RUSSIA Country Report May 2024 www.intellinews.com