Page 51 - UKRRptNov22

P. 51

or the National Bank on the need to transfer control in the bank to the state or another shareholder, they are ready to donate its shares, according to a letter from co-owner of the bank Mikhail Fridman to NBU Governor Andriy Pyshny.

Ukraine’s central bank is still waiting on paperwork from Alfa-Bank for its potential $1bn recapitalization. The National Bank of Ukraine said that once it does, it will review the documents for their compliance with legal standards and norms. This recapitalization for Ukraine’s 7th-largest bank would be provided by unfreezing some of the Monaco-stored assets of its sanctioned owner, Russian oligarch Mikhail Fridman. The bank has subsequently said the plan for the additional capitalization was not related to Fridman’s personal interests.

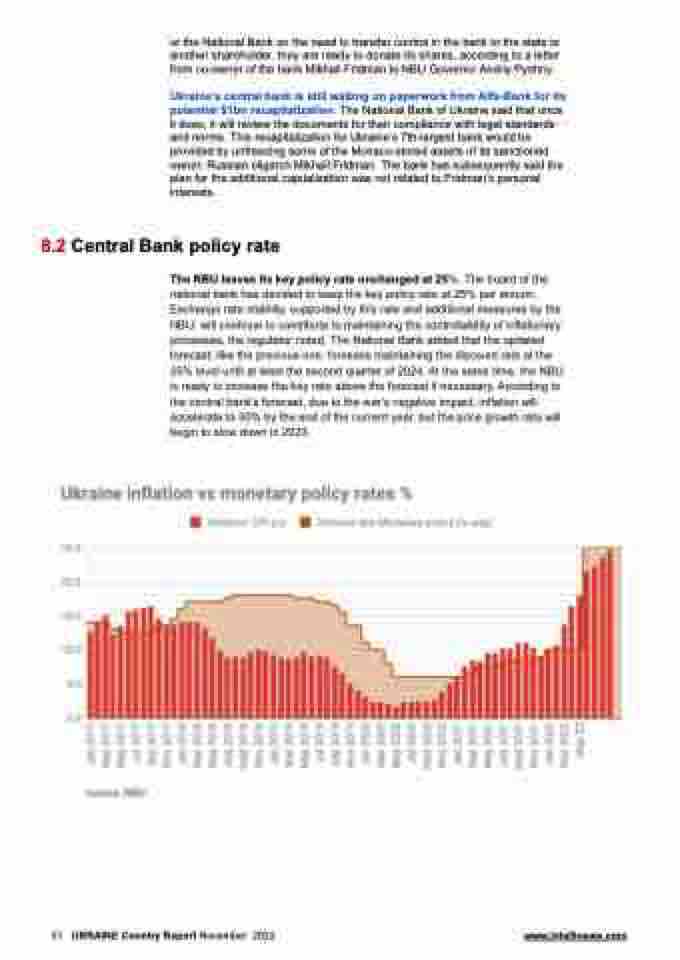

8.2 Central Bank policy rate

The NBU leaves Its key policy rate unchanged at 25%. The board of the national bank has decided to keep the key policy rate at 25% per annum. Exchange rate stability, supported by this rate and additional measures by the NBU, will continue to contribute to maintaining the controllability of inflationary processes, the regulator noted. The National Bank added that the updated forecast, like the previous one, foresees maintaining the discount rate at the 25% level until at least the second quarter of 2024. At the same time, the NBU is ready to increase the key rate above the forecast if necessary. According to the central bank's forecast, due to the war’s negative impact, inflation will accelerate to 30% by the end of the current year, but the price growth rate will begin to slow down in 2023.

51 UKRAINE Country Report November 2022 www.intellinews.com