Page 98 - RusRPTDec22

P. 98

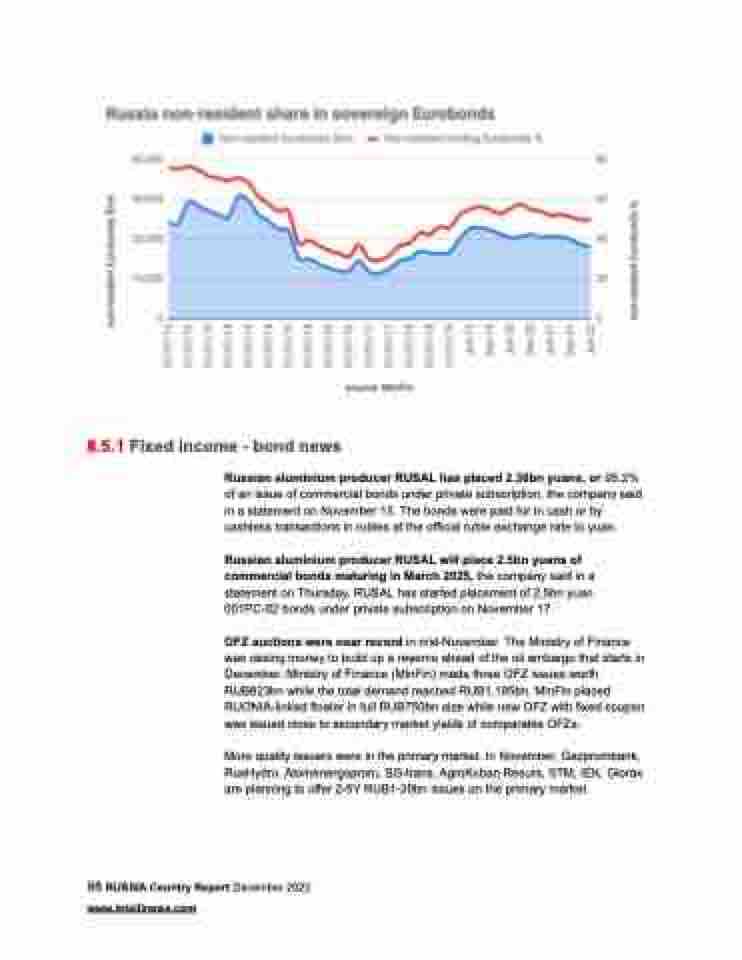

8.5.1 Fixed income - bond news

Russian aluminium producer RUSAL has placed 2.38bn yuans, or 95.2% of an issue of commercial bonds under private subscription, the company said in a statement on November 15. The bonds were paid for in cash or by cashless transactions in rubles at the official ruble exchange rate to yuan.

Russian aluminium producer RUSAL will place 2.5bn yuans of commercial bonds maturing in March 2025, the company said in a statement on Thursday. RUSAL has started placement of 2.5bn yuan 001PC-02 bonds under private subscription on November 17.

OFZ auctions were near record in mid-November. The Ministry of Finance was raising money to build up a reserve ahead of the oil embargo that starts in December. Ministry of Finance (MinFin) made three OFZ issues worth RUB823bn while the total demand reached RUB1,195bn. MinFin placed RUONIA-linked floater in full RUB750bn size while new OFZ with fixed coupon was issued close to secondary market yields of comparable OFZs.

More quality issuers were in the primary market. In November, Gazprombank, RusHydro, Atomenergoprom, SG-trans, AgroKuban Resurs, STM, IEK, Glorax are planning to offer 2-5Y RUB1-20bn issues on the primary market.

98 RUSSIA Country Report December 2022 www.intellinews.com