Page 7 - EurOil Week 30

P. 7

EurOil COMMENTARY EurOil

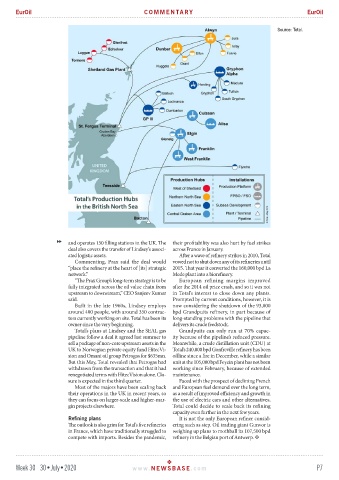

Source: Total.

and operates 150 filling stations in the UK. The their profitability was also hurt by fuel strikes

deal also covers the transfer of Lindsey’s associ- across France in January.

ated logistic assets. After a wave of refinery strikes in 2010, Total

Commenting, Prax said the deal would vowed not to shut down any of its refineries until

“place the refinery at the heart of [its] strategic 2015. That year it converted the 160,000 bpd La

network.” Mede plant into a biorefinery.

“The Prax Group’s long-term strategy is to be European refining margins improved

fully integrated across the oil value chain from after the 2014 oil price crash, and so it was not

upstream to downstream,” CEO Sanjeev Kumar in Total’s interest to close down any plants.

said. Prompted by current conditions, however, it is

Built in the late 1960s, Lindsey employs now considering the shutdown of the 93,000

around 400 people, with around 350 contrac- bpd Grandpuits refinery, in part because of

tors currently working on site. Total has been its long-standing problems with the pipeline that

owner since the very beginning. delivers its crude feedstock.

Total’s plans at Lindsey and the SEAL gas Grandpuits can only run at 70% capac-

pipeline follow a deal it agreed last summer to ity because of the pipeline’s reduced pressure.

sell a package of non-core upstream assets in the Meanwhile, a crude distillation unit (CDU) at

UK to Norwegian private equity fund HitecVi- Total’s 240,000 bpd Gonfreville refinery has been

sion and Omani oil group Petrogas for $635mn. offline since a fire in December, while a similar

But this May, Total revealed that Petrogas had unit at the 105,000 bpd Feyzin plant has not been

withdrawn from the transaction and that it had working since February, because of extended

renegotiated terms with HitecVision alone. Clo- maintenance.

sure is expected in the third quarter. Faced with the prospect of declining French

Most of the majors have been scaling back and European fuel demand over the long term,

their operations in the UK in recent years, so as a result of improved efficiency and growth in

they can focus on larger-scale and higher-mar- the use of electric cars and other alternatives,

gin projects elsewhere. Total could decide to scale back its refining

capacity even further in the next few years.

Refining plans It is not the only European refiner consid-

The outlook is also grim for Total’s five refineries ering such as step. Oil trading giant Gunvor is

in France, which have traditionally struggled to weighing up plans to mothball its 107,500 bpd

compete with imports. Besides the pandemic, refinery in the Belgian port of Antwerp.

Week 30 30•July•2020 www. NEWSBASE .com P7