Page 93 - SE Outlook Regions 2023

P. 93

3.4 Real economy - Croatia

3.4.1 Retail

Croatia’s retail trade, which started recovering from the coronavirus

pandemic in 2021, continued the upward trend at the start of 2022.

However, the surging consumer prices put an end to that trend in the

second half of the year. In the first months of 2023, retail sales are

expected to decline further due to the expected recession. However,

stabilisation of energy prices and cooling inflation could revive the retail

sales.

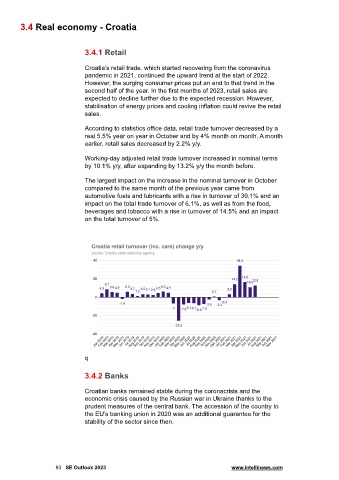

According to statistics office data, retail trade turnover decreased by a

real 5.5% year on year in October and by 4% month on month. A month

earlier, retail sales decreased by 2.2% y/y.

Working-day adjusted retail trade turnover increased in nominal terms

by 10.1% y/y, after expanding by 13.2% y/y the month before.

The largest impact on the increase in the nominal turnover in October

compared to the same month of the previous year came from

automotive fuels and lubricants with a rise in turnover of 30.1% and an

impact on the total trade turnover of 6.1%, as well as from the food,

beverages and tobacco with a rise in turnover of 14.5% and an impact

on the total turnover of 5%.

q

3.4.2 Banks

Croatian banks remained stable during the coronacrisis and the

economic crisis caused by the Russian war in Ukraine thanks to the

prudent measures of the central bank. The accession of the country to

the EU’s banking union in 2020 was an additional guarantee for the

stability of the sector since then.

93 SE Outlook 2023 www.intellinews.com