Page 78 - RusRPTMar23

P. 78

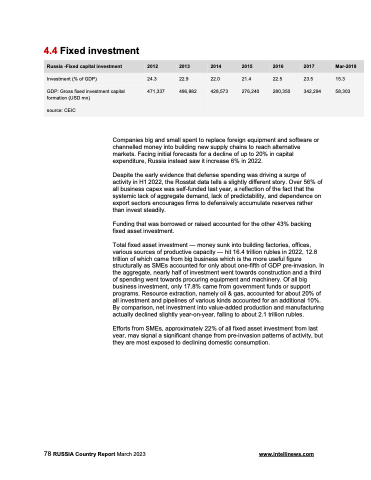

4.4 Fixed investment

Russia -Fixed capital investment 2012 2013 2014 2015 2016 2017 Mar-2018

Investment (% of GDP)

24.3 22.9 22.0 21.4 22.5 23.5 15.3

GDP: Gross fixed investment capital formation (USD mn)

source: CEIC

471,337 496,982 428,573 276,240 280,350 342,294 58,303

Companies big and small spent to replace foreign equipment and software or channelled money into building new supply chains to reach alternative markets. Facing initial forecasts for a decline of up to 20% in capital expenditure, Russia instead saw it increase 6% in 2022.

Despite the early evidence that defense spending was driving a surge of activity in H1 2022, the Rosstat data tells a slightly different story. Over 56% of all business capex was self-funded last year, a reflection of the fact that the systemic lack of aggregate demand, lack of predictability, and dependence on export sectors encourages firms to defensively accumulate reserves rather than invest steadily.

Funding that was borrowed or raised accounted for the other 43% backing fixed asset investment.

Total fixed asset investment — money sunk into building factories, offices, various sources of productive capacity — hit 16.4 trillion rubles in 2022, 12.8 trillion of which came from big business which is the more useful figure structurally as SMEs accounted for only about one-fifth of GDP pre-invasion. In the aggregate, nearly half of investment went towards construction and a third of spending went towards procuring equipment and machinery. Of all big business investment, only 17.8% came from government funds or support programs. Resource extraction, namely oil & gas, accounted for about 20% of all investment and pipelines of various kinds accounted for an additional 10%. By comparison, net investment into value-added production and manufacturing actually declined slightly year-on-year, falling to about 2.1 trillion rubles.

Efforts from SMEs, approximately 22% of all fixed asset investment from last year, may signal a significant change from pre-invasion patterns of activity, but they are most exposed to declining domestic consumption.

78 RUSSIA Country Report March 2023 www.intellinews.com