Page 93 - RusRPTApr24

P. 93

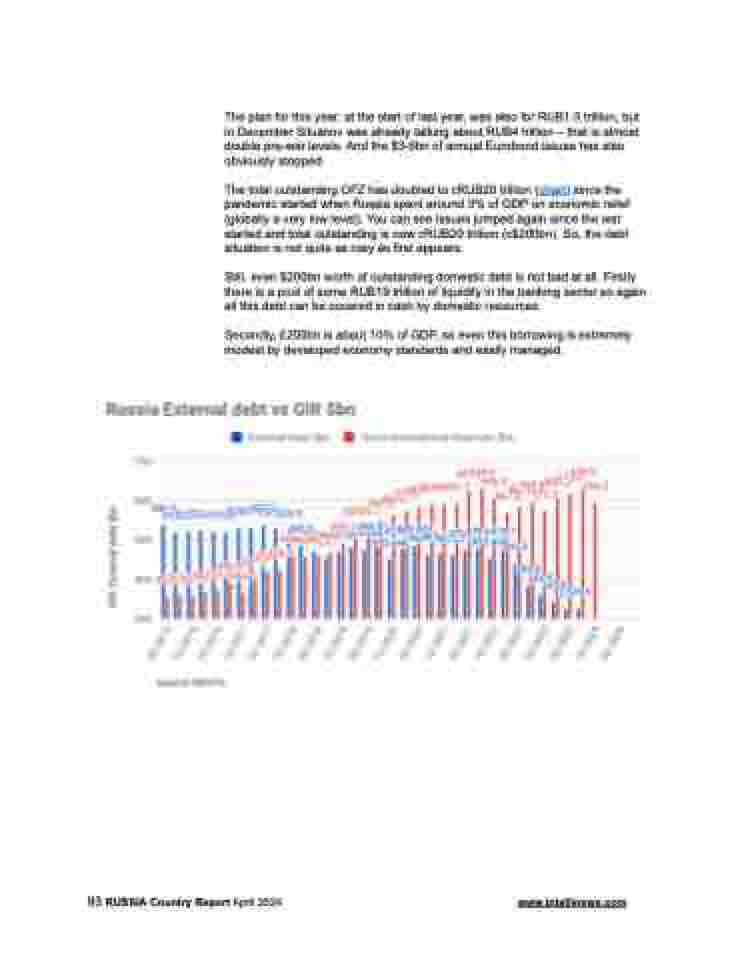

The plan for this year, at the start of last year, was also for RUB1.5 trillion, but in December Siluanov was already talking about RUB4 trillion – that is almost double pre-war levels. And the $3-6bn of annual Eurobond issues has also obviously stopped.

The total outstanding OFZ has doubled to cRUB20 trillion (chart) since the pandemic started when Russia spent around 3% of GDP on economic relief (globally a very low level). You can see issues jumped again since the war started and total outstanding is now cRUB20 trillion (c$200bn). So, the debt situation is not quite as rosy as first appears.

Still, even $200bn worth of outstanding domestic debt is not bad at all. Firstly there is a pool of some RUB19 trillion of liquidity in the banking sector so again all this debt can be covered in cash by domestic resources.

Secondly, £200bn is about 10% of GDP, so even this borrowing is extremely modest by developed economy standards and easily managed.

93 RUSSIA Country Report April 2024 www.intellinews.com