Page 32 - UKRRptJan22

P. 32

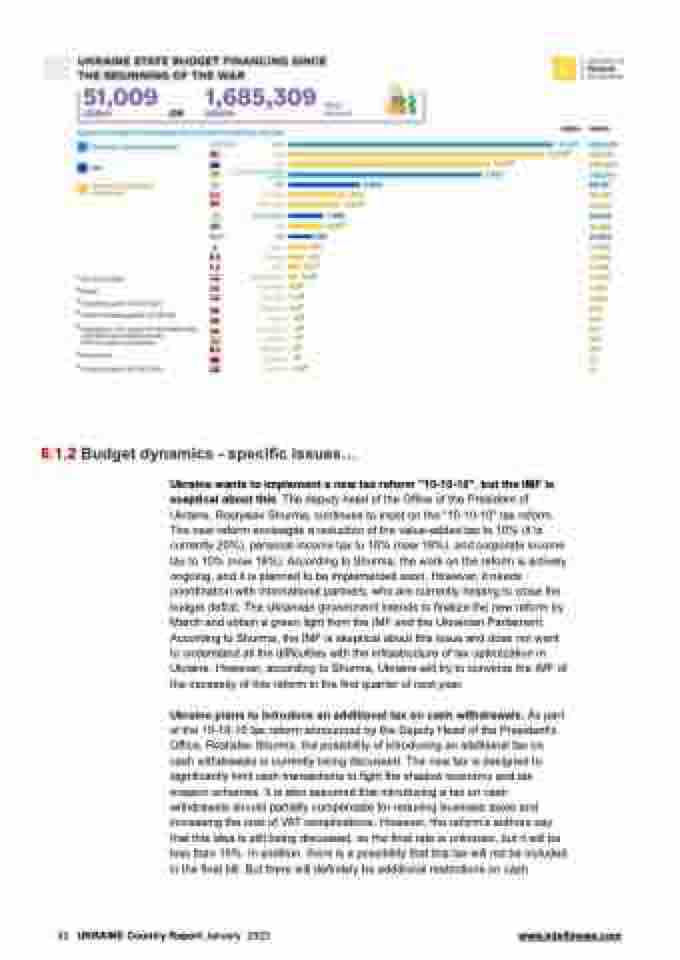

6.1.2 Budget dynamics - specific issues...

Ukraine wants to implement a new tax reform "10-10-10", but the IMF is sceptical about this. The deputy head of the Office of the President of Ukraine, Rostyslav Shurma, continues to insist on the "10-10-10" tax reform. The new reform envisages a reduction of the value-added tax to 10% (it is currently 20%), personal income tax to 10% (now 18%), and corporate income tax to 10% (now 18%). According to Shurma, the work on the reform is actively ongoing, and it is planned to be implemented soon. However, it needs coordination with international partners, who are currently helping to close the budget deficit. The Ukrainian government intends to finalize the new reform by March and obtain a green light from the IMF and the Ukrainian Parliament. According to Shurma, the IMF is skeptical about this issue and does not want to understand all the difficulties with the infrastructure of tax optimization in Ukraine. However, according to Shurma, Ukraine will try to convince the IMF of the necessity of this reform in the first quarter of next year.

Ukraine plans to introduce an additional tax on cash withdrawals. As part of the 10-10-10 tax reform announced by the Deputy Head of the President's Office, Rostislav Shurma, the possibility of introducing an additional tax on cash withdrawals is currently being discussed. The new tax is designed to significantly limit cash transactions to fight the shadow economy and tax evasion schemes. It is also assumed that introducing a tax on cash withdrawals should partially compensate for reducing business taxes and increasing the cost of VAT complications. However, the reform's authors say that this idea is still being discussed, so the final rate is unknown, but it will be less than 10%. In addition, there is a possibility that this tax will not be included in the final bill. But there will definitely be additional restrictions on cash

32 UKRAINE Country Report January 2023 www.intellinews.com