Page 49 - UKRRptDec22

P. 49

8.1.2 Loans

Loans for Ukrainians have become more expensive, but the yield on deposits has not changed. In October, the average interest rates on new bank loans in hryvnia amounted to 37.8% per annum. Interest rates increased by 1.6% compared to the previous month, reported the NBU. Interest rates on new consumer loans in foreign currency fell from 4.7% to 4.2% per annum. Interest rates on commercial hryvnia loans decreased from 19.8% to 19.7% per annum, and foreign currency loan rates increased from 5.5% to 6%. Bank credit portfolios decreased by 1.3% to UAH 1,054B. The average bank interest rate on new hryvnia consumer savings deposits amounted to 9.2% per annum. Compared to September, rates increased by 0.1%. Interest rates on new consumer savings accounts in foreign currency fell by 0.1%, up to 0.7%. Interest rates on commercial hryvnia savings accounts for enterprises fell from 9.3% to 9.2% per annum, and foreign currency account rates increased from 1.2% to 1.4% per annum.

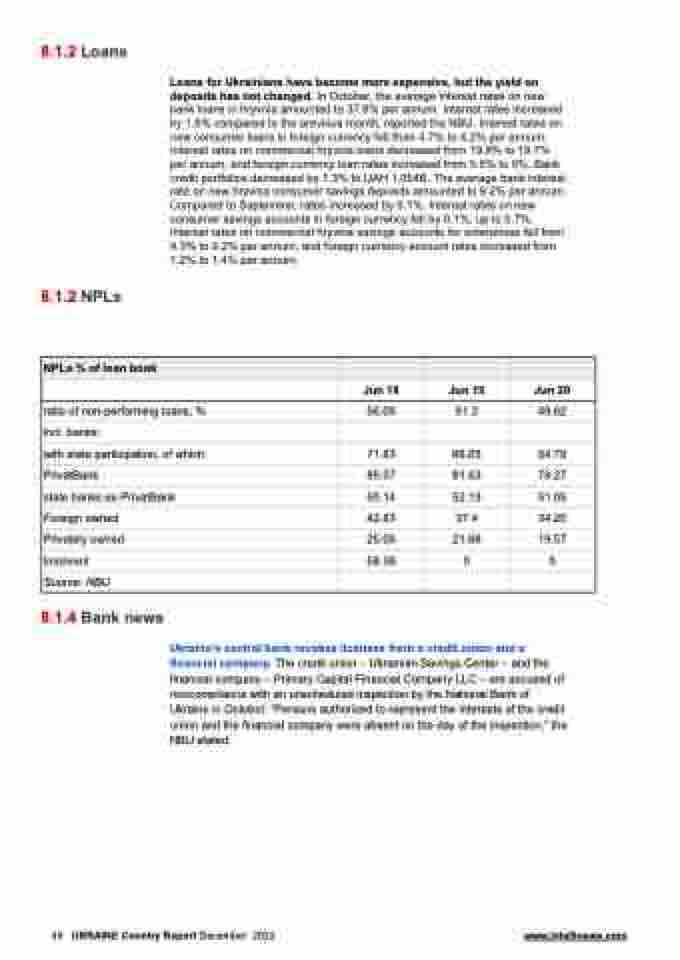

8.1.2 NPLs

NPLs % of loan book

Jun 18

Jun 19

Jun 20

ratio of non-performing loans, %

56.05

51.3

49.62

incl. banks:

with state participation, of which:

71.83

66.03

64.79

PrivatBank

85.07

81.63

79.27

state banks ex-PrivatBank

60.14

52.13

51.05

Foreign owned

42.83

37.4

34.25

Privately owned

25.05

21.68

19.57

Insolvent

58.38

0

0

Source: NBU

8.1.4 Bank news

Ukraine’s central bank revokes licenses from a credit union and a financial company. The credit union – Ukrainian Savings Center – and the financial company – Primary Capital Financial Company LLC – are accused of noncompliance with an unscheduled inspection by the National Bank of Ukraine in October. “Persons authorized to represent the interests of the credit union and the financial company were absent on the day of the inspection,” the NBU stated.

49 UKRAINE Country Report December 2022 www.intellinews.com