Page 51 - UKRRptDec22

P. 51

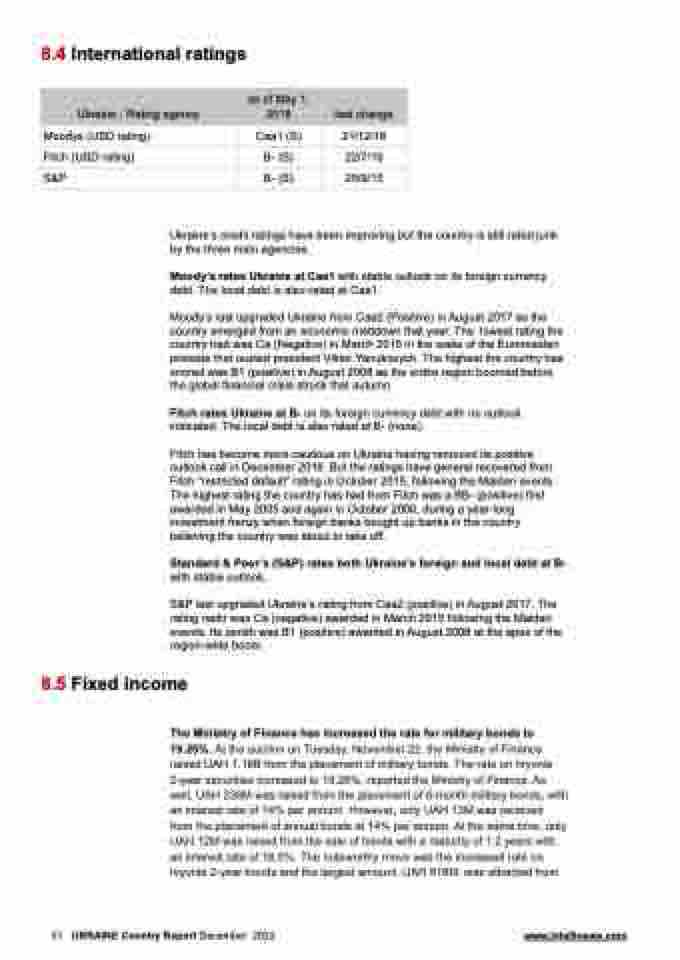

8.4 International ratings

Ukraine - Rating agency

as of May 1, 2018

last change

Moodys (USD rating)

Caa1 (S)

21/12/18

Fitch (USD rating)

B- (S)

22/7/16

S&P

B- (S)

25/9/15

Ukraine’s credit ratings have been improving but the country is still rated junk by the three main agencies.

Moody’s rates Ukraine at Caa1 with stable outlook on its foreign currency debt. The local debt is also rated at Caa1.

Moody’s last upgraded Ukraine from Caa2 (Positive) in August 2017 as the country emerged from an economic meltdown that year. The lowest rating the country had was Ca (Negative) in March 2015 in the wake of the Euromaidan protests that ousted president Viktor Yanukovych. The highest the country has scored was B1 (positive) in August 2008 as the entire region boomed before the global financial crisis struck that autumn.

Fitch rates Ukraine at B- on its foreign currency debt with no outlook indicated. The local debt is also rated at B- (none).

Fitch has become more cautious on Ukraine having removed its positive outlook call in December 2018. But the ratings have general recovered from Fitch “restricted default” rating in October 2015, following the Maidan events. The highest rating the country has had from Fitch was a BB- (positive) first awarded in May 2005 and again in October 2006, during a year-long investment frenzy when foreign banks bought up banks in the country believing the country was about to take off.

Standard & Poor’s (S&P) rates both Ukraine’s foreign and local debt at B-

with stable outlook.

S&P last upgraded Ukraine’s rating from Caa2 (positive) in August 2017. The rating nadir was Ca (negative) awarded in March 2015 following the Maidan events. Its zenith was B1 (positive) awarded in August 2008 at the apex of the region-wide boom.

8.5 Fixed income

The Ministry of Finance has increased the rate for military bonds to 19.25%. At the auction on Tuesday, November 22, the Ministry of Finance raised UAH 1.18B from the placement of military bonds. The rate on hryvnia 2-year securities increased to 19.25%, reported the Ministry of Finance. As well, UAH 236M was raised from the placement of 6-month military bonds, with an interest rate of 14% per annum. However, only UAH 13M was received from the placement of annual bonds at 14% per annum. At the same time, only UAH 12M was raised from the sale of bonds with a maturity of 1.2 years with an interest rate of 18.5%. The noteworthy move was the increased rate on hryvnia 2-year bonds and the largest amount, UAH 918M, was attracted from

51 UKRAINE Country Report December 2022 www.intellinews.com