Page 52 - UKRRptDec22

P. 52

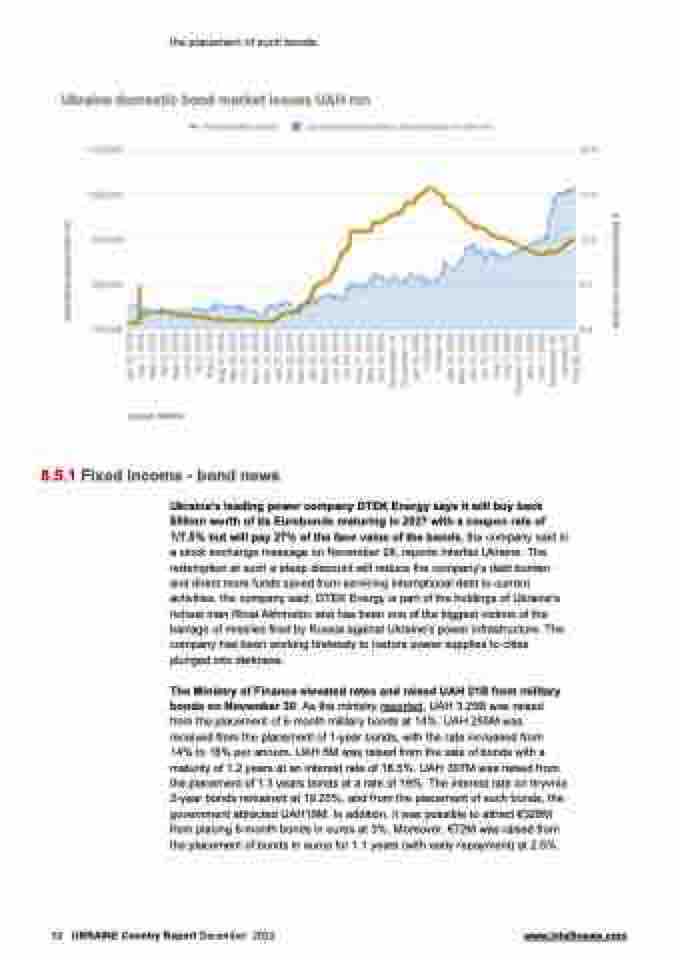

8.5.1 Fixed income - bond news

the placement of such bonds.

Ukraine’s leading power company DTEK Energy says it will buy back $50mn worth of its Eurobonds maturing in 2027 with a coupon rate of 7/7.5% but will pay 27% of the face value of the bonds, the company said in a stock exchange message on November 28, reports Interfax Ukraine. The redemption at such a steep discount will reduce the company's debt burden and direct more funds saved from servicing international debt to current activities, the company said. DTEK Energy is part of the holdings of Ukraine’s richest man Rinat Akhmetov and has been one of the biggest victims of the barrage of missiles fired by Russia against Ukraine’s power infrastructure. The company has been working tirelessly to restore power supplies to cities plunged into darkness.

The Ministry of Finance elevated rates and raised UAH 21B from military bonds on November 30. As the ministry reported, UAH 3.25B was raised from the placement of 6-month military bonds at 14%. UAH 255M was received from the placement of 1-year bonds, with the rate increased from 14% to 16% per annum. UAH 5M was raised from the sale of bonds with a maturity of 1.2 years at an interest rate of 18.5%. UAH 307M was raised from the placement of 1.3 years bonds at a rate of 19%. The interest rate on hryvnia 2-year bonds remained at 19.25%, and from the placement of such bonds, the government attracted UAH19M. In addition, it was possible to attract €328M from placing 6-month bonds in euros at 3%. Moreover, €72M was raised from the placement of bonds in euros for 1.1 years (with early repayment) at 2.5%.

52 UKRAINE Country Report December 2022 www.intellinews.com