Page 12 - MEOG Week 10 2023

P. 12

MEOG PROJECTS & COMPANIES MEOG

TotalEnergies expands

UAE upstream portfolio

UAE TOTALENERGIES has agreed to purchase the such as documentation formalisation and final

upstream assets of Spanish firm CEPSA in the approvals.

UAE, while adding a stake in a Japanese-led joint The company’s chairman and CEO Patrick

venture (JV) that operates other offshore assets. Pouyanné said that the deals would “further

The assets to be acquired include a 20% bolster” the company’s presence in Abu Dhabi.

participating interest in the Satah Al Razboot “The acquisition of a 20% working interest in the

(SARB), Umm al-Lulu, Bin Nasher and Al Bateel SARB and Umm al-Lulu concession aligns per-

(SARB and Umm al-Lulu) offshore concession, fectly with our strategy of focusing on low-cost,

and a 12.88% indirect interest in the Mubarraz low-emission assets,” he added.

concession. In September 2020, OMV announced the

The latter was acquired through the purchase start of production from the full-field develop-

of a 20% stake in Cosmo Abu Dhabi Energy ments of Umm al-Lulu and SARB – which were

Exploration & Production Co. Ltd (CEPAD), a combined in the second of the three new offshore

company that owns a 64.4% stake that was held concessions.

by Abu Dhabi Oil Company Ltd (ADOC), the Combined output commenced at 50,000

operator of Mubarraz. bpd and a month or so after production began,

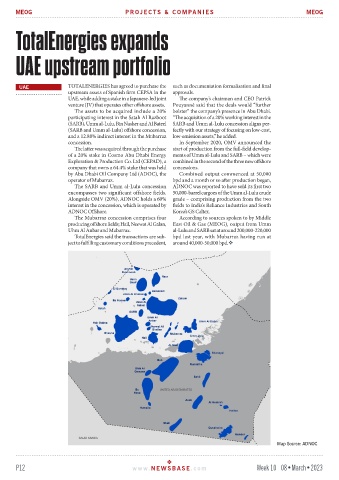

The SARB and Umm al-Lulu concession ADNOC was reported to have sold its first two

encompasses two significant offshore fields. 50,000-barrel cargoes of the Umm al-Lulu crude

Alongside OMV (20%), ADNOC holds a 60% grade – comprising production from the two

interest in the concession, which is operated by fields to India’s Reliance Industries and South

ADNOC Offshore. Korea’s GS Caltex.

The Mubarraz concession comprises four According to sources spoken to by Middle

producing offshore fields; Hail, Neewat Al Galan, East Oil & Gas (MEOG), output from Umm

Uhm Al Anbar and Mubarraz. al-Lulu and SARB sat at around 200,000-220,000

TotalEnergies said the transactions are sub- bpd last year, with Mubarraz having run at

ject to fulfilling customary conditions precedent, around 40,000-50,000 bpd.

Map Source: ADNOC

P12 www. NEWSBASE .com Week 10 08•March•2023