Page 117 - SE Outlook Regions 2024

P. 117

The industries that lost ground at a high rate are many, like the reasons behind them: coal mining (decarbonisation), light industry (rising wages), chemistry (expensive natural gas), metallurgy (expensive energy), wood processing (tighter regulations) and even construction materials (decelerating residential real estate development).

Very few industries posted notable growth rates: the automobile industry, manufacturing of electronic and optical devices (partly for the automotive industry), food and beverages (rising domestic demand) and the tobacco industry (the most resilient industry so far).

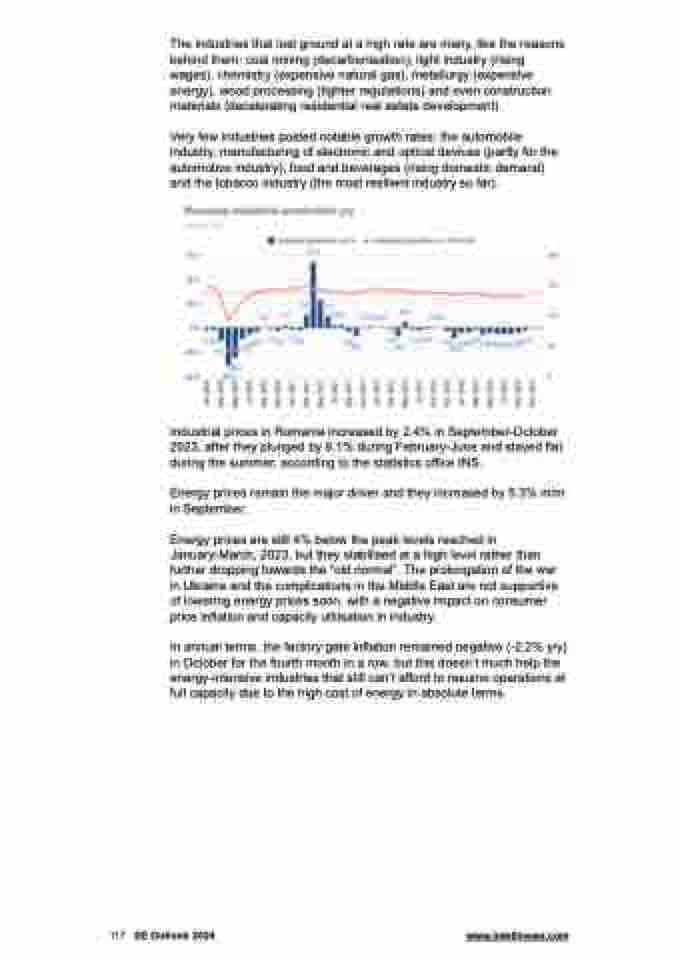

Industrial prices in Romania increased by 2.4% in September-October 2023, after they plunged by 6.1% during February-June and stayed flat during the summer, according to the statistics office INS.

Energy prices remain the major driver and they increased by 5.3% m/m in September.

Energy prices are still 4% below the peak levels reached in January-March, 2023, but they stabilised at a high level rather than further dropping towards the “old normal”. The prolongation of the war in Ukraine and the complications in the Middle East are not supportive of lowering energy prices soon, with a negative impact on consumer price inflation and capacity utilisation in industry.

In annual terms, the factory gate inflation remained negative (-2.2% y/y) in October for the fourth month in a row, but this doesn’t much help the energy-intensive industries that still can’t afford to resume operations at full capacity due to the high cost of energy in absolute terms.

117 SE Outlook 2024 www.intellinews.com