Page 115 - SE Outlook Regions 2024

P. 115

This time, the banks’ profitability is built not on quick lending (the stock of loans was only 4.5% up y/y as of September) but on robust net interest income. Household purchasing power is much stronger compared to 2007-2008 and the companies are in a stronger financial position, which translates into significant “consumption” of loans – on the other hand visible in banks’ profits, counted as value-added and a positive contribution to overall economic growth.

High profitability means banks can afford to pay 7.5% coupons on their euro-denominated MREL bonds, a yield that may seem impressive but is only a fraction of their ROE ratio.

Indeed, the non-performing loans (NPL) ratio was only 2.6% at the end of September 2023, down from 2.8% in September 2022 and 3.8% in September 2021. Banks’ assets increased by 11.5% to RON757.3bn (€152.2bn) at the end of September – nearly three times faster than the stock of loans (+4.5% y/y). The loan-to-deposit ratio remains below 70%. The ratio was lower only during the COVID-19 crisis when lending was frozen for a period before the government stepped in and provided abundant guarantees for corporate lending.

Romanian banks have shifted their focus to refinancing and boosted their profits.

New loan data combined with the dynamics of the stock of loans, published by the National Bank of Romania (BNR), indicate that the banks have massively shifted their focus to refinancing over the past year – quite successfully judging from the banks' record January-September aggregated profits.

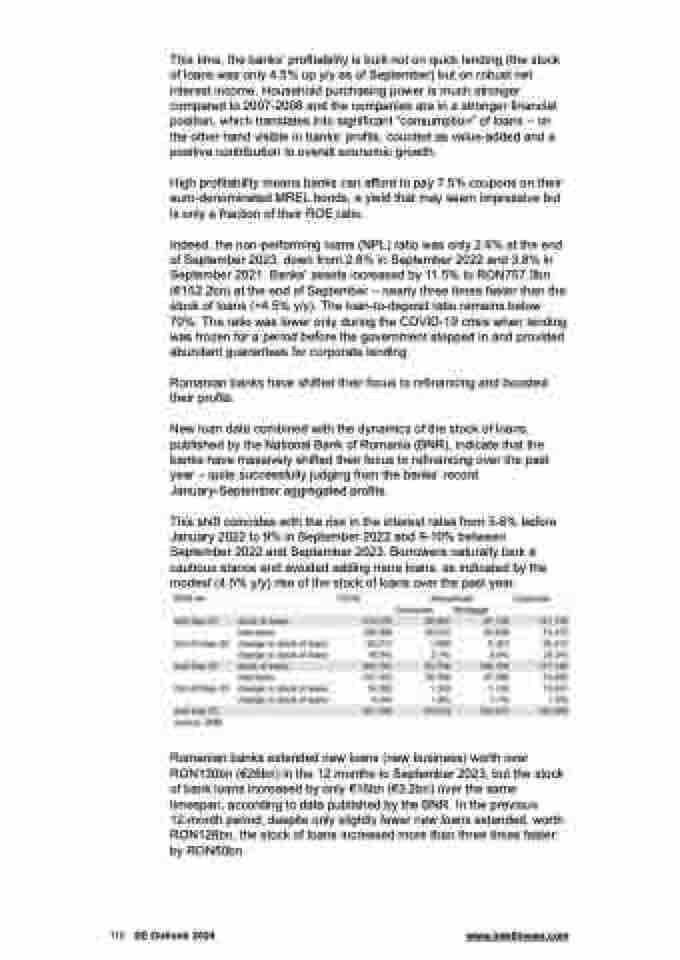

This shift coincides with the rise in the interest rates from 5-6% before January 2022 to 9% in September 2022 and 9-10% between September 2022 and September 2023. Borrowers naturally took a cautious stance and avoided adding more loans, as indicated by the modest (4.5% y/y) rise of the stock of loans over the past year.

Romanian banks extended new loans (new business) worth over RON130bn (€26bn) in the 12 months to September 2023, but the stock of bank loans increased by only €16bn (€3.2bn) over the same timespan, according to data published by the BNR. In the previous 12-month period, despite only slightly fewer new loans extended, worth RON126bn, the stock of loans increased more than three times faster: by RON50bn.

115 SE Outlook 2024 www.intellinews.com