Page 114 - SE Outlook Regions 2024

P. 114

goods were relatively stronger (+4.8% y/y) and food sales increased as well (+4.0% y/y).

As a trend for the entire year 2023, food and non-food sales (seasonally adjusted) have stagnated at a level superior to the averages in 2022 while fuel sales have decreased and edged down as average compared to 2022.

As of October 2023, the retail sales in the rolling 12 months increased by 2.4% y/y, driven by the 4.2% advance of non-food sales (indicating significant consumer confidence), +2.7% y/y advance of food sales and -1.7% y/y contraction of fuel sales.

5.9.2 Banks

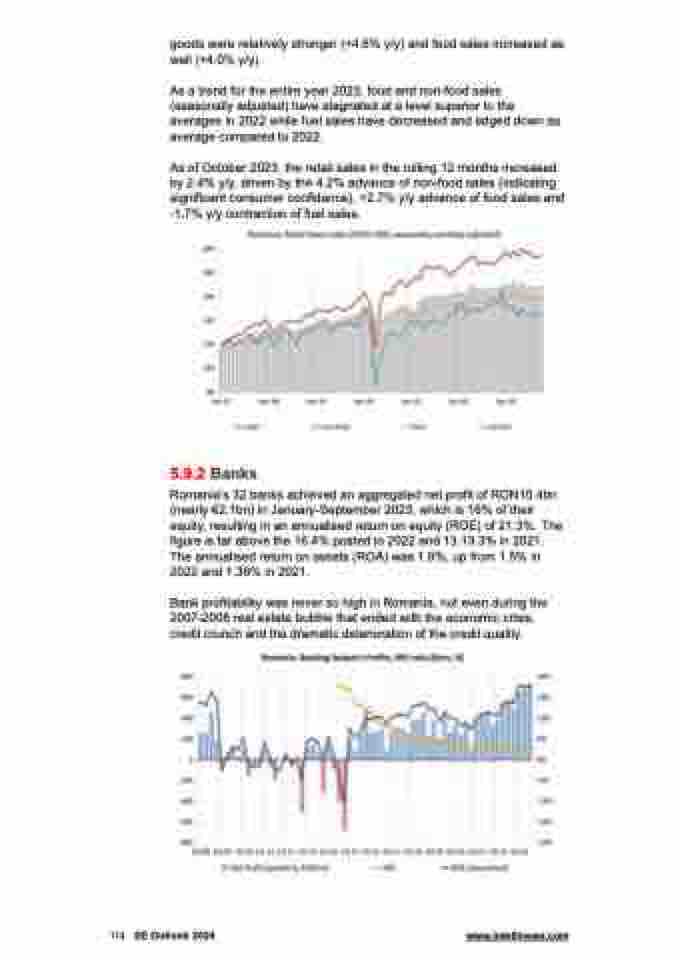

Romania’s 32 banks achieved an aggregated net profit of RON10.4bn (nearly €2.1bn) in January-September 2023, which is 16% of their equity, resulting in an annualised return on equity (ROE) of 21.3%. The figure is far above the 16.4% posted in 2022 and 13.13.3% in 2021. The annualised return on assets (ROA) was 1.9%, up from 1.5% in 2022 and 1.36% in 2021.

Bank profitability was never so high in Romania, not even during the 2007-2008 real estate bubble that ended with the economic crisis, credit crunch and the dramatic deterioration of the credit quality.

114 SE Outlook 2024 www.intellinews.com