Page 60 - SE Outlook Regions 2024

P. 60

Moldova’s foreign trade was severely impacted by the political conflict with Russia, which abandoned the preferential prices starting in Q4 2021 after Maia Sandu won the presidential election. Moldova paid the price of political independence in the form of more expensive gas purchased from Russia and from the free market, but eventually, it achieved relative energy independence – or at least escaped the dependence on Russian gas.

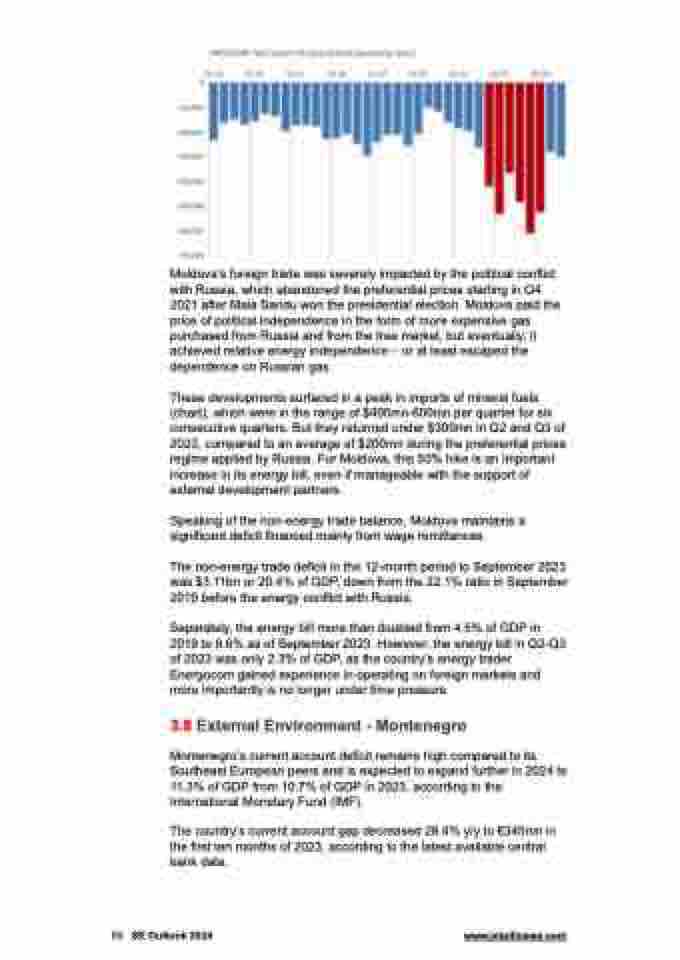

These developments surfaced in a peak in imports of mineral fuels (chart), which were in the range of $400mn-600mn per quarter for six consecutive quarters. But they returned under $300mn in Q2 and Q3 of 2023, compared to an average of $200mn during the preferential prices regime applied by Russia. For Moldova, this 50% hike is an important increase in its energy bill, even if manageable with the support of external development partners.

Speaking of the non-energy trade balance, Moldova maintains a significant deficit financed mainly from wage remittances.

The non-energy trade deficit in the 12-month period to September 2023 was $3.11bn or 20.4% of GDP, down from the 22.1% ratio in September 2019 before the energy conflict with Russia.

Separately, the energy bill more than doubled from 4.5% of GDP in 2019 to 9.6% as of September 2023. However, the energy bill in Q2-Q3 of 2023 was only 2.3% of GDP, as the country’s energy trader Energocom gained experience in operating on foreign markets and more importantly is no longer under time pressure.

3.8 External Environment - Montenegro

Montenegro’s current account deficit remains high compared to its Southeast European peers and is expected to expand further in 2024 to 11.3% of GDP from 10.7% of GDP in 2023, according to the International Monetary Fund (IMF).

The country’s current account gap decreased 28.4% y/y to €345mn in the first ten months of 2023, according to the latest available central bank data.

60 SE Outlook 2024 www.intellinews.com