Page 12 - TURKRptNov22

P. 12

So, the summer decline in gas imports did not produce the expected recovery in the trade balance. The central bankers worked harder to write bigger tourism revenues.

● USD/TRY: Latest record - 18.8760 recorded on December 1. Since September 28, USD/TRY has been testing the 18.60-level.

Turkey’s five-year credit default swaps (CDS) remain above the 700-level. The yield on the Turkish government’s 10-year eurobonds remains above the 10%-level.

● Balance of Payments: The current account deficit ran wild again.

Financial flows stopped; as a result, they are stable. Turks are waking up as the USD/TRY rate is rising again.

Debt-rollovers continue undeterred but with no fresh inflow. In October, the autumn season for Turkish banks’ syndicated loan renewals was to began. Eurobond auctions stopped in March. Net FDI remains around zero.

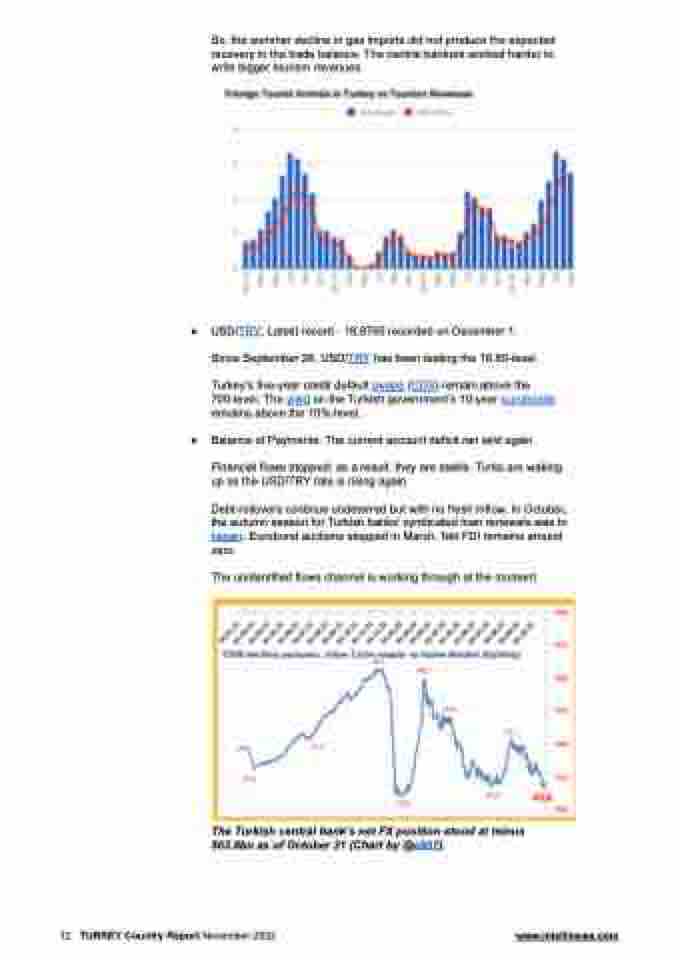

The unidentified flows channel is working through at the moment.

The Turkish central bank’s net FX position stood at minus $63.8bn as of October 21 (Chart by @e507).

12 TURKEY Country Report November 2022 www.intellinews.com