Page 23 - Ukraine OUTLOOK 2025

P. 23

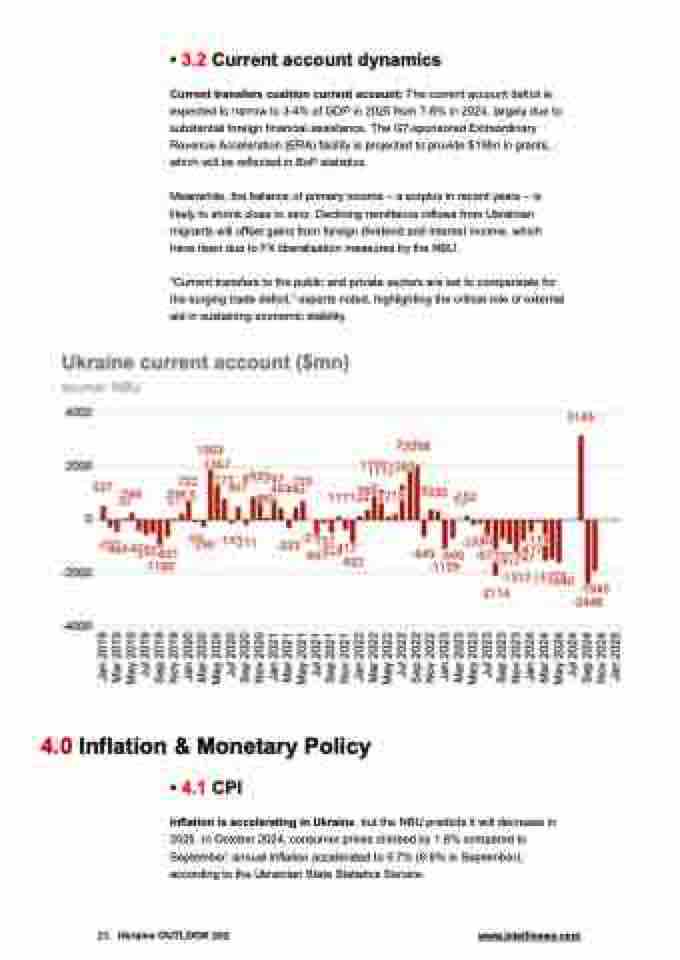

• 3.2 Current account dynamics

Current transfers cushion current account: The current account deficit is expected to narrow to 3-4% of GDP in 2025 from 7-8% in 2024, largely due to substantial foreign financial assistance. The G7-sponsored Extraordinary Revenue Acceleration (ERA) facility is projected to provide $19bn in grants, which will be reflected in BoP statistics.

Meanwhile, the balance of primary income – a surplus in recent years – is likely to shrink close to zero. Declining remittance inflows from Ukrainian migrants will offset gains from foreign dividend and interest income, which have risen due to FX liberalisation measures by the NBU.

“Current transfers to the public and private sectors are set to compensate for the surging trade deficit,” experts noted, highlighting the critical role of external aid in sustaining economic stability.

4.0 Inflation & Monetary Policy

• 4.1 CPI

Inflation is accelerating in Ukraine, but the NBU predicts it will decrease in 2025. In October 2024, consumer prices climbed by 1.8% compared to September; annual inflation accelerated to 9.7% (8.6% in September), according to the Ukrainian State Statistics Service.

23 Ukraine OUTLOOK 202 www.intellinews.com