Page 27 - Ukraine OUTLOOK 2025

P. 27

Ukraine will be able to confront Russia without US assistance during the first half of 2025 on December 11. However, the likely termination of US aid to Ukraine could become a serious challenge, so Ukraine needs a plan for cooperation with the new US administration, said Minister of Finance Serhiy Marchenko.

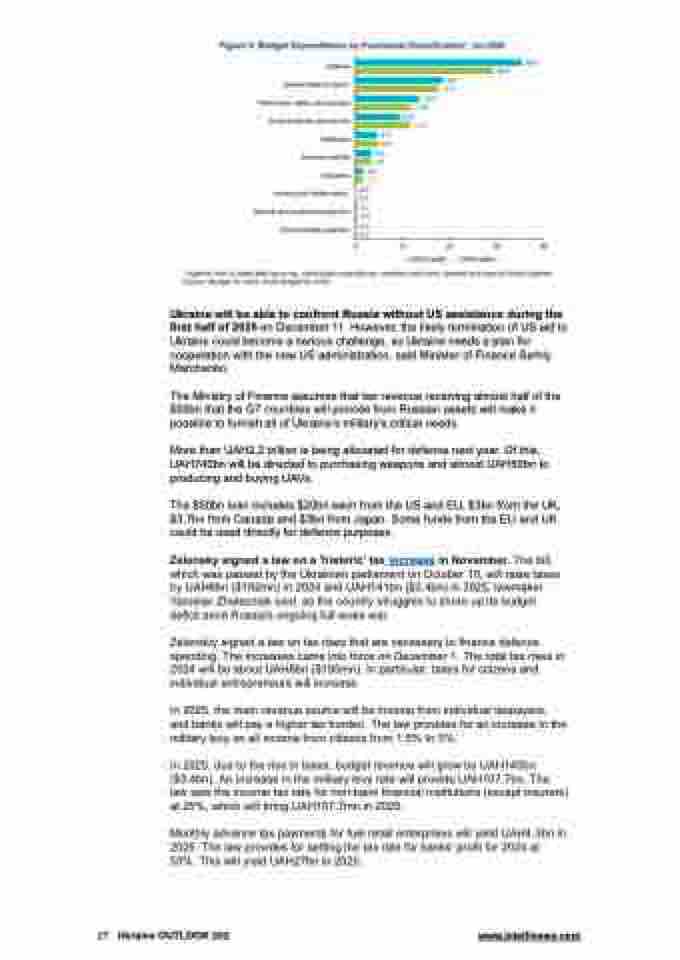

The Ministry of Finance assumes that tax revenue receiving almost half of the $50bn that the G7 countries will provide from Russian assets will make it possible to furnish all of Ukraine’s military's critical needs.

More than UAH2.2 trillion is being allocated for defence next year. Of this, UAH740bn will be directed to purchasing weapons and almost UAH50bn to producing and buying UAVs.

The $50bn loan includes $20bn each from the US and EU, $3bn from the UK, $3.7bn from Canada and $3bn from Japan. Some funds from the EU and UK could be used directly for defence purposes.

Zelensky signed a law on a 'historic' tax increase in November. The bill, which was passed by the Ukrainian parliament on October 10, will raise taxes by UAH8bn ($192mn) in 2024 and UAH141bn ($3.4bn) in 2025, lawmaker Yaroslav Zhelezniak said, as the country struggles to shore up its budget deficit amid Russia's ongoing full-scale war.

Zelenskiy signed a law on tax rises that are necessary to finance defence spending. The increases came into force on December 1. The total tax rises in 2024 will be about UAH8bn ($195mn). In particular, taxes for citizens and individual entrepreneurs will increase.

In 2025, the main revenue source will be income from individual taxpayers, and banks will pay a higher tax burden. The law provides for an increase in the military levy on all income from citizens from 1.5% to 5%.

In 2025, due to the rise in taxes, budget revenue will grow by UAH140bn ($3.4bn). An increase in the military levy rate will provide UAH107.7bn. The law sets the income tax rate for non-bank financial institutions (except insurers) at 25%, which will bring UAH157.7mn in 2025.

Monthly advance tax payments for fuel retail enterprises will yield UAH4.3bn in 2025. The law provides for setting the tax rate for banks' profit for 2024 at 50%. This will yield UAH27bn in 2025.

27 Ukraine OUTLOOK 202 www.intellinews.com