Page 29 - Ukraine OUTLOOK 2025

P. 29

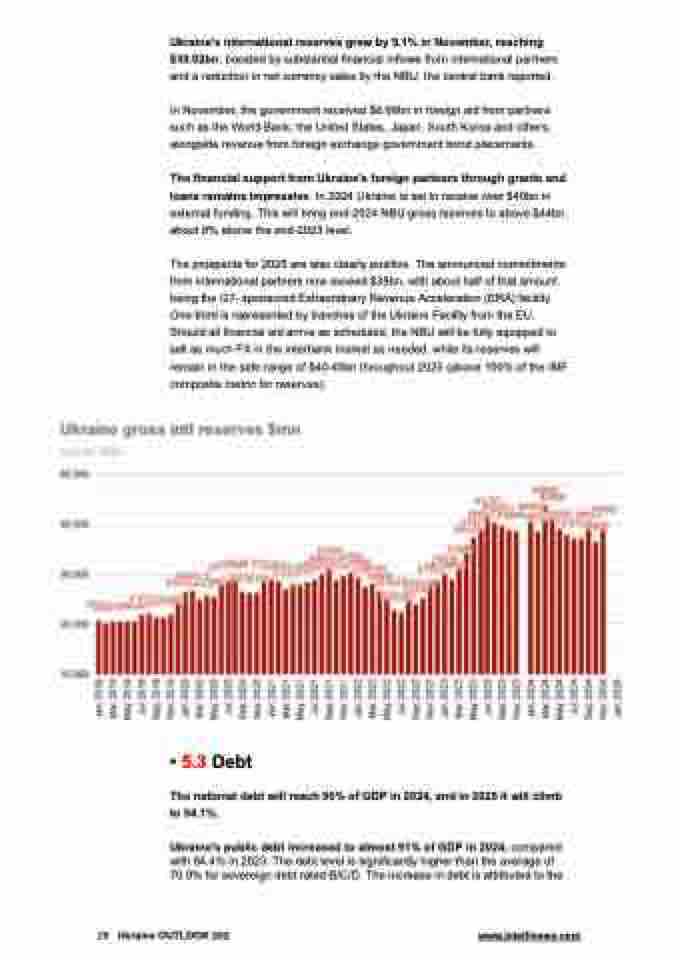

Ukraine's international reserves grew by 9.1% in November, reaching $39.92bn, boosted by substantial financial inflows from international partners and a reduction in net currency sales by the NBU, the central bank reported.

In November, the government received $6.68bn in foreign aid from partners such as the World Bank, the United States, Japan, South Korea and others, alongside revenue from foreign exchange government bond placements.

The financial support from Ukraine's foreign partners through grants and loans remains impressive. In 2024 Ukraine is set to receive over $40bn in external funding. This will bring end-2024 NBU gross reserves to above $44bn, about 9% above the end-2023 level.

The prospects for 2025 are also clearly positive. The announced commitments from international partners now exceed $38bn, with about half of that amount being the G7- sponsored Extraordinary Revenue Acceleration (ERA) facility. One-third is represented by tranches of the Ukraine Facility from the EU. Should all financial aid arrive as scheduled, the NBU will be fully equipped to sell as much FX in the interbank market as needed, while its reserves will remain in the safe range of $40-45bn throughout 2025 (above 100% of the IMF composite metric for reserves).

• 5.3 Debt

The national debt will reach 90% of GDP in 2024, and in 2025 it will climb

to 94.1%.

Ukraine's public debt increased to almost 91% of GDP in 2024, compared with 84.4% in 2023. The debt level is significantly higher than the average of 70.9% for sovereign debt rated B/C/D. The increase in debt is attributed to the

29 Ukraine OUTLOOK 202 www.intellinews.com