Page 65 - bne IntelliNews Southeastern Europe Outlook 2025

P. 65

The natural gas price hike as of December 1, 2024 and possibly electricity price hikes later may further stir inflationary pressures and the central bank will have to reconsider its expansionary monetary policy.

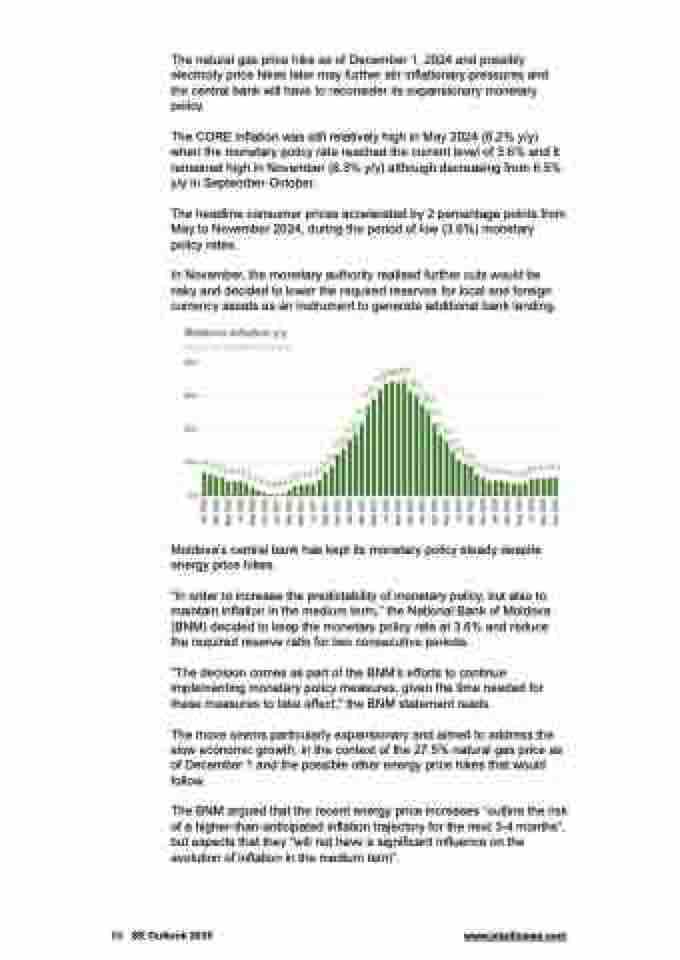

The CORE inflation was still relatively high in May 2024 (6.2% y/y) when the monetary policy rate reached the current level of 3.6% and it remained high in November (6.3% y/y) although decreasing from 6.5% y/y in September-October.

The headline consumer prices accelerated by 2 percentage points from May to November 2024, during the period of low (3.6%) monetary policy rates.

In November, the monetary authority realised further cuts would be risky and decided to lower the required reserves for local and foreign currency assets as an instrument to generate additional bank lending.

Moldova’s central bank has kept its monetary policy steady despite energy price hikes.

“In order to increase the predictability of monetary policy, but also to maintain inflation in the medium term,” the National Bank of Moldova (BNM) decided to keep the monetary policy rate at 3.6% and reduce the required reserve ratio for two consecutive periods.

"The decision comes as part of the BNM’s efforts to continue implementing monetary policy measures, given the time needed for these measures to take effect," the BNM statement reads.

The move seems particularly expansionary and aimed to address the slow economic growth, in the context of the 27.5% natural gas price as of December 1 and the possible other energy price hikes that would follow.

The BNM argued that the recent energy price increases “outline the risk of a higher-than-anticipated inflation trajectory for the next 3-4 months”, but expects that they “will not have a significant influence on the evolution of inflation in the medium term”.

65 SE Outlook 2025 www.intellinews.com