Page 70 - bne IntelliNews Southeastern Europe Outlook 2025

P. 70

Incomes (wages) have a visible impact on inflation and on loan interest rates, the BNR governor stated as well.

"Consumer loans are correlated with income growth. Because otherwise we have no way to explain these developments at high interest rates of consumer credit. Quite active increases in consumer credit," said Isarescu.

4.10 Inflation & Monetary Policy – Serbia

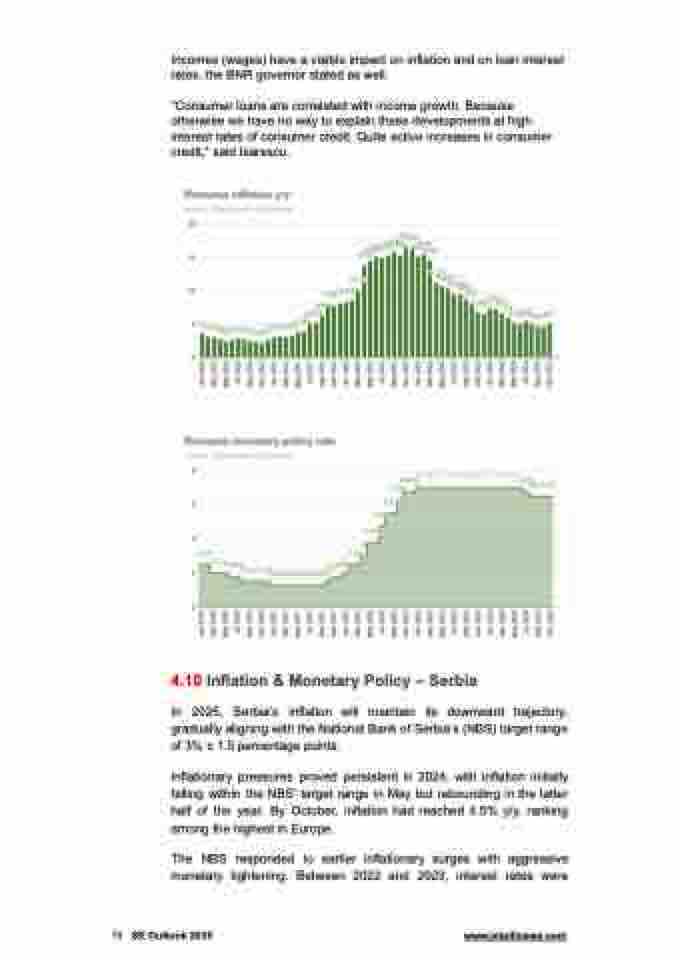

In 2025, Serbia’s inflation will maintain its downward trajectory, gradually aligning with the National Bank of Serbia’s (NBS) target range of 3% ± 1.5 percentage points.

Inflationary pressures proved persistent in 2024, with inflation initially falling within the NBS’ target range in May but rebounding in the latter half of the year. By October, inflation had reached 4.5% y/y, ranking among the highest in Europe.

The NBS responded to earlier inflationary surges with aggressive monetary tightening. Between 2022 and 2023, interest rates were

70 SE Outlook 2025 www.intellinews.com