Page 68 - bne IntelliNews Southeastern Europe Outlook 2025

P. 68

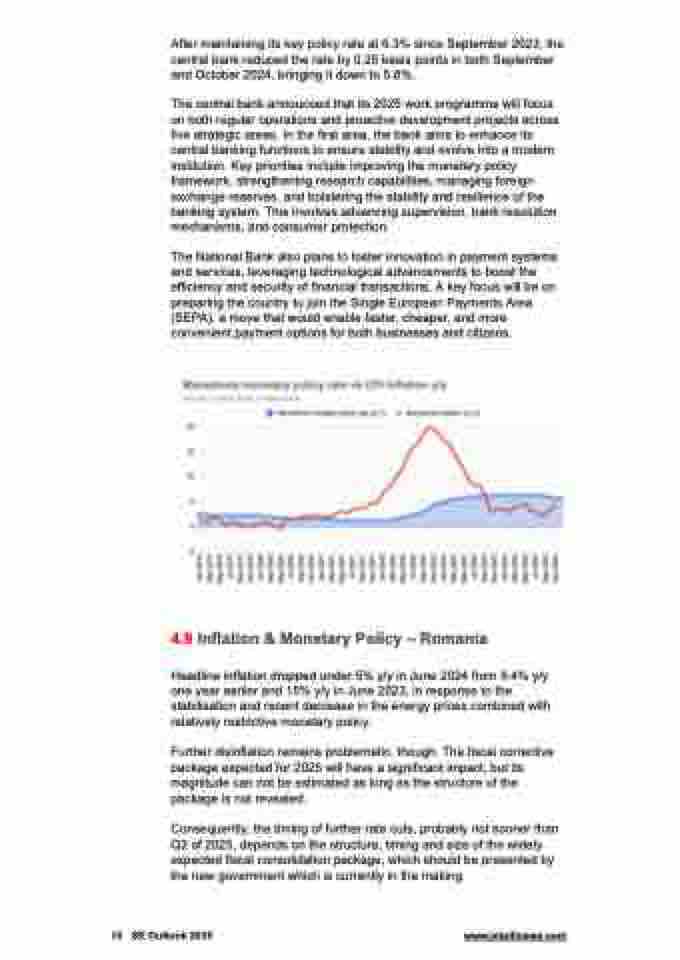

After maintaining its key policy rate at 6.3% since September 2023, the central bank reduced the rate by 0.25 basis points in both September and October 2024, bringing it down to 5.8%.

The central bank announced that its 2025 work programme will focus on both regular operations and proactive development projects across five strategic areas. In the first area, the bank aims to enhance its central banking functions to ensure stability and evolve into a modern institution. Key priorities include improving the monetary policy framework, strengthening research capabilities, managing foreign exchange reserves, and bolstering the stability and resilience of the banking system. This involves advancing supervision, bank resolution mechanisms, and consumer protection.

The National Bank also plans to foster innovation in payment systems and services, leveraging technological advancements to boost the efficiency and security of financial transactions. A key focus will be on preparing the country to join the Single European Payments Area (SEPA), a move that would enable faster, cheaper, and more convenient payment options for both businesses and citizens.

4.9 Inflation & Monetary Policy – Romania

Headline inflation dropped under 5% y/y in June 2024 from 9.4% y/y one year earlier and 15% y/y in June 2023, in response to the stabilisation and recent decrease in the energy prices combined with relatively restrictive monetary policy.

Further disinflation remains problematic, though. The fiscal corrective package expected for 2025 will have a significant impact, but its magnitude can not be estimated as long as the structure of the package is not revealed.

Consequently, the timing of further rate cuts, probably not sooner than Q2 of 2025, depends on the structure, timing and size of the widely expected fiscal consolidation package, which should be presented by the new government which is currently in the making.

68 SE Outlook 2025 www.intellinews.com