Page 10 - TURKRptJun22

P. 10

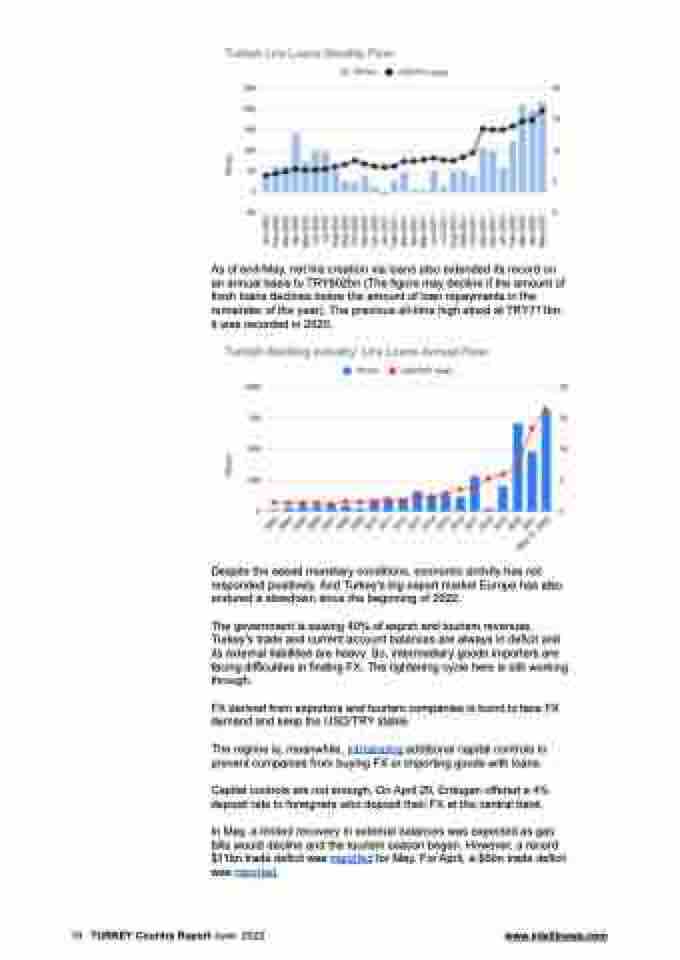

As of end-May, net lira creation via loans also extended its record on an annual basis to TRY802bn (The figure may decline if the amount of fresh loans declines below the amount of loan repayments in the remainder of the year). The previous all-time high stood at TRY711bn. It was recorded in 2020.

Despite the eased monetary conditions, economic activity has not responded positively. And Turkey's big export market Europe has also endured a slowdown since the beginning of 2022.

The government is seizing 40% of export and tourism revenues. Turkey’s trade and current account balances are always in deficit and its external liabilities are heavy. So, intermediary goods importers are facing difficulties in finding FX. The tightening cycle here is still working through.

FX derived from exporters and tourism companies is burnt to face FX demand and keep the USD/TRY stable.

The regime is, meanwhile, introducing additional capital controls to prevent companies from buying FX or importing goods with loans.

Capital controls are not enough. On April 20, Erdogan offered a 4% deposit rate to foreigners who deposit their FX at the central bank.

In May, a limited recovery in external balances was expected as gas bills would decline and the tourism season began. However, a record $11bn trade deficit was reported for May. For April, a $6bn trade deficit was reported.

10 TURKEY Country Report June 2022 www.intellinews.com