Page 27 - UKRRptFeb23

P. 27

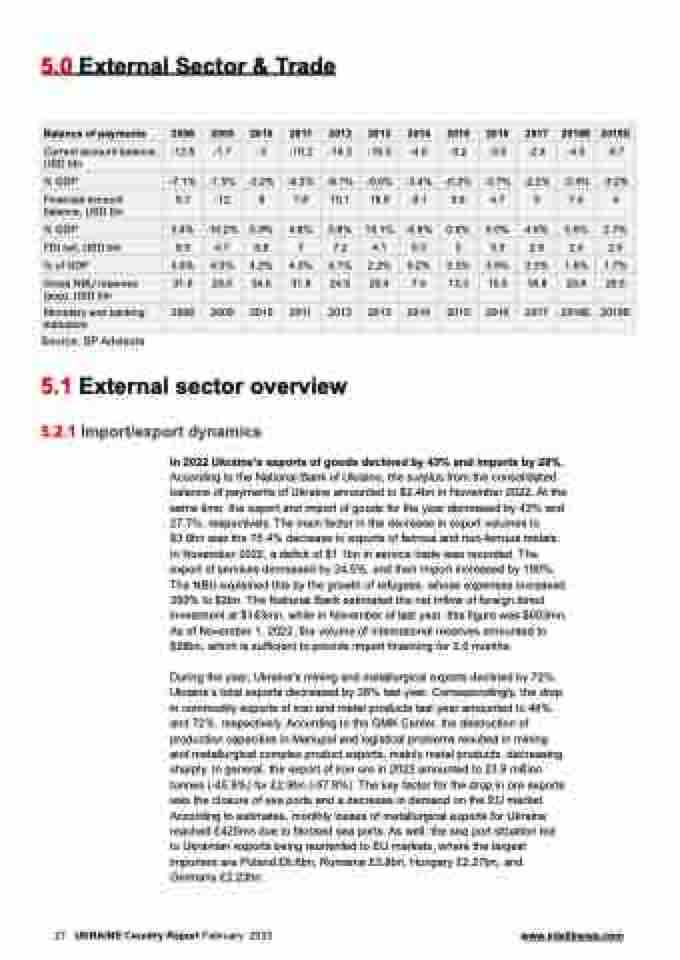

5.0 External Sector & Trade

Balance of payments

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018E

2019E

Current account balance, USD bln

-12.8

-1.7

-3

-10.2

-14.3

-16.5

-4.6

-0.2

-3.5

-2.4

-4.5

-4.7

% GDP

-7.1%

-1.5%

-2.2%

-6.3%

-8.1%

-9.0%

-3.4%

-0.2%

-3.7%

-2.2%

-3.4%

-3.2%

Financial account balance, USD bln

9.7

-12

8

7.8

10.1

18.6

-9.1

0.6

4.7

5

7.4

4

% GDP

5.4%

-10.2%

5.9%

4.8%

5.8%

10.1%

-6.8%

0.6%

5.0%

4.5%

5.6%

2.7%

FDI net, USD bln

9.9

4.7

5.8

7

7.2

4.1

0.3

3

3.3

2.6

2.4

2.5

% of GDP

5.5%

4.0%

4.2%

4.3%

4.1%

2.2%

0.2%

3.3%

3.5%

2.3%

1.8%

1.7%

Gross NBU reserves (eop), USD bln

31.5

26.5

34.6

31.8

24.5

20.4

7.5

13.3

15.5

18.8

20.8

20.5

Monetary and banking indicators

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018E

2019E

Source: SP Advisors

5.1 External sector overview 5.2.1 Import/export dynamics

In 2022 Ukraine's exports of goods declined by 43% and imports by 28%.

According to the National Bank of Ukraine, the surplus from the consolidated balance of payments of Ukraine amounted to $2.4bn in November 2022. At the same time, the export and import of goods for the year decreased by 43% and 27.7%, respectively. The main factor in the decrease in export volumes to $3.6bn was the 75.4% decrease in exports of ferrous and non-ferrous metals. In November 2022, a deficit of $1.1bn in service trade was recorded. The export of services decreased by 24.5%, and their import increased by 190%. The NBU explained this by the growth of refugees, whose expenses increased 390% to $2bn. The National Bank estimated the net inflow of foreign direct investment at $143mn, while in November of last year, this figure was $603mn. As of November 1, 2022, the volume of international reserves amounted to $28bn, which is sufficient to provide import financing for 3.5 months.

During the year, Ukraine's mining and metallurgical exports declined by 72%. Ukraine’s total exports decreased by 38% last year. Correspondingly, the drop in commodity exports of iron and metal products last year amounted to 46% and 72%, respectively. According to the GMK Center, the destruction of production capacities in Mariupol and logistical problems resulted in mining and metallurgical complex product exports, mainly metal products, decreasing sharply. In general, the export of iron ore in 2022 amounted to 23.9 million tonnes (-45.9%) for £2.9bn (-57.8%). The key factor for the drop in ore exports was the closure of sea ports and a decrease in demand on the EU market. According to estimates, monthly losses of metallurgical exports for Ukraine reached £420mn due to blocked sea ports. As well, the sea port situation led to Ukrainian exports being reoriented to EU markets, where the largest importers are Poland £6.6bn, Romania £3.8bn, Hungary £2.27bn, and Germany £2.23bn.

27 UKRAINE Country Report February 2023 www.intellinews.com