Page 38 - IRANRptJun22

P. 38

Iran, meanwhile, needs to make more headway in facing the tobacco sector challenges of rife smuggling, grey import trading and fake production issues. The severity of the grey market problems became so great that the Rouhani administration, which finished its second term in office last year, promoted local production of international brands including Camel and Winston.

International tobacco players including British American Tobacco, JPI and Japan Tobacco have a presence in Iran.

6.3 Debt

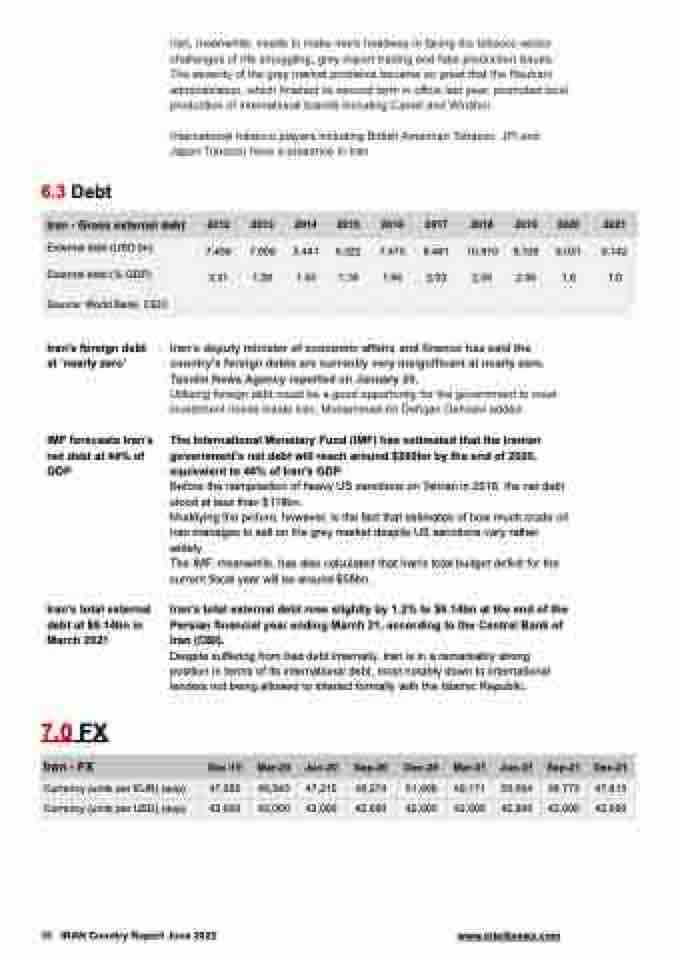

Iran - Gross external debt 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

External debt (USD bn)

7.406 7.006 5.441 6.322 7.475 8.481 10.910 9.339 9.031 9.142

External debt (% GDP)

3.31 1.28 1.45 1.18 1.94 2.03 2.45 2.05 1.6 1.0

Source: World Bank, CEIC

Iran’s foreign debt at ‘nearly zero’

IMF forecasts Iran’s net debt at 44% of GDP

Iran’s total external debt at $9.14bn in March 2021

Iran’s deputy minister of economic affairs and finance has said the country’s foreign debts are currently very insignificant at nearly zero, Tasnim News Agency reported on January 20.

Utilising foreign debt could be a good opportunity for the government to meet investment needs inside Iran, Mohammad-Ali Dehqan Dehnavi added.

The International Monetary Fund (IMF) has estimated that the Iranian government's net debt will reach around $260bn by the end of 2020, equivalent to 44% of Iran's GDP.

Before the reimposition of heavy US sanctions on Tehran in 2018, the net debt stood at less than $118bn.

Muddying the picture, however, is the fact that estimates of how much crude oil Iran manages to sell on the grey market despite US sanctions vary rather widely.

The IMF, meanwhile, has also calculated that Iran's total budget deficit for the current fiscal year will be around $58bn.

Iran's total external debt rose slightly by 1.2% to $9.14bn at the end of the Persian financial year ending March 21, according to the Central Bank of Iran (CBI).

Despite suffering from bad debt internally, Iran is in a remarkably strong position in terms of its international debt, most notably down to international lenders not being allowed to interact formally with the Islamic Republic.

7.0 FX

Iran - FX

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Currency (units per EUR) (eop)

47,055

46,543

47,215

49,274

51,609

49,171

50,004

48,773

47,613

Currency (units per USD) (eop)

42,000

42,000

42,000

42,000

42,000

42,000

42,000

42,000

42,000

38 IRAN Country Report June 2022 www.intellinews.com