Page 39 - IRANRptJun22

P. 39

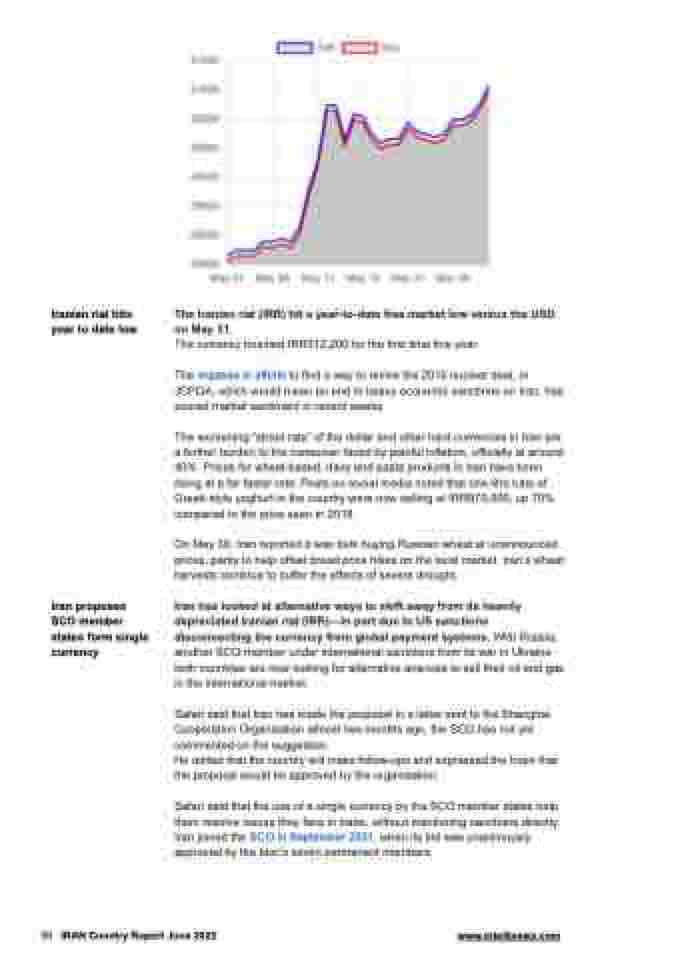

Iranian rial hits year to date low

The Iranian rial (IRR) hit a year-to-date free market low versus the USD on May 31.

The currency touched IRR312,200 for the first time this year.

The impasse in efforts to find a way to revive the 2015 nuclear deal, or JCPOA, which would mean an end to heavy economic sanctions on Iran, has soured market sentiment in recent weeks.

The worsening “street rate” of the dollar and other hard currencies in Iran are a further burden to the consumer faced by painful inflation, officially at around 40%. Prices for wheat-based, dairy and pasta products in Iran have been rising at a far faster rate. Posts on social media noted that one litre tubs of Greek-style yoghurt in the country were now selling at IRR970,000, up 70% compared to the price seen in 2018.

On May 30, Iran reported it was bulk buying Russian wheat at unannounced prices, partly to help offset bread price hikes on the local market. Iran’s wheat harvests continue to suffer the effects of severe drought.

Iran has looked at alternative ways to shift away from its heavily depreciated Iranian rial (IRR)—in part due to US sanctions disconnecting the currency from global payment systems. With Russia, another SCO member under international sanctions from its war in Ukraine both countries are now looking for alternative avenues to sell their oil and gas in the international market.

Safari said that Iran has made the proposal in a letter sent to the Shanghai Cooperation Organisation almost two months ago, the SCO has not yet commented on the suggestion.

He added that the country will make follow-ups and expressed the hope that the proposal would be approved by the organisation.

Safari said that the use of a single currency by the SCO member states help them resolve issues they face in trade, without mentioning sanctions directly. Iran joined the SCO in September 2021, when its bid was unanimously approved by the bloc’s seven permanent members.

Iran proposes SCO member states form single currency

39 IRAN Country Report June 2022 www.intellinews.com