Page 11 - TURKRptSep22

P. 11

● USD/TRY: Latest record - 18.8760 recorded on December 1. As of August 30, USD/TRY was testing the 18.20-level.

Turkey’s five-year credit default swaps (CDS) remain above the 700-level. The yield on the Turkish government’s 10-year eurobonds remains above the 10%-level.

● Balance of Payments: The current account deficit ran wild again.

Financial flows stopped; as a result, they are stable. Turks are waking up as the USD/TRY rate is rising again.

Debt-rollovers continue undeterred but with no fresh inflow. Eurobond auctions stopped in March. Net FDI remains around zero.

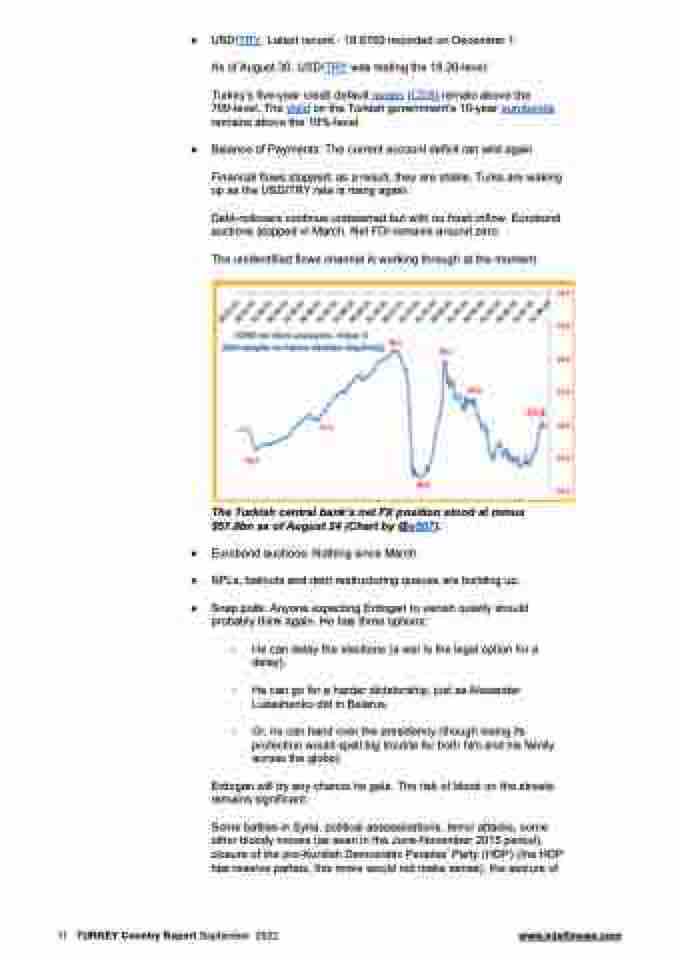

The unidentified flows channel is working through at the moment.

The Turkish central bank’s net FX position stood at minus $57.8bn as of August 24 (Chart by @e507).

● Eurobond auctions: Nothing since March.

● NPLs, bailouts and debt restructuring queues are building up.

● Snap polls: Anyone expecting Erdogan to vanish quietly should probably think again. He has three options:

- He can delay the elections (a war is the legal option for a delay).

- He can go for a harder dictatorship, just as Alexander Lukashenko did in Belarus.

- Or, he can hand over the presidency (though losing its protection would spell big trouble for both him and his family across the globe).

Erdogan will try any chance he gets. The risk of blood on the streets remains significant.

Some battles in Syria, political assassinations, terror attacks, some other bloody moves (as seen in the June-November 2015 period), closure of the pro-Kurdish Democratic Peoples’ Party (HDP) (the HDP has reserve parties, this move would not make sense), the seizure of

11 TURKEY Country Report September 2022 www.intellinews.com