Page 10 - TURKRptSep22

P. 10

The government is seizing 40% of export and tourism revenues. Those companies that want to use export rediscount credits from the central bank are now obliged to sell 70% of their export revenues and to sign a document that shows they will not buy FX for the next one month.

Turkey’s trade and current account balances are always in deficit and its external liabilities are heavy. So, intermediary goods importers are facing difficulties in finding FX. The tightening cycle here is still working through.

FX derived from exporters and tourism companies is burnt to face FX demand and keep the USD/TRY stable.

The regime is, meanwhile, introducing additional capital controls to prevent companies from buying FX or importing goods with loans.

Capital controls are not enough. Some desperate attempts to find some fresh FX are taking place.

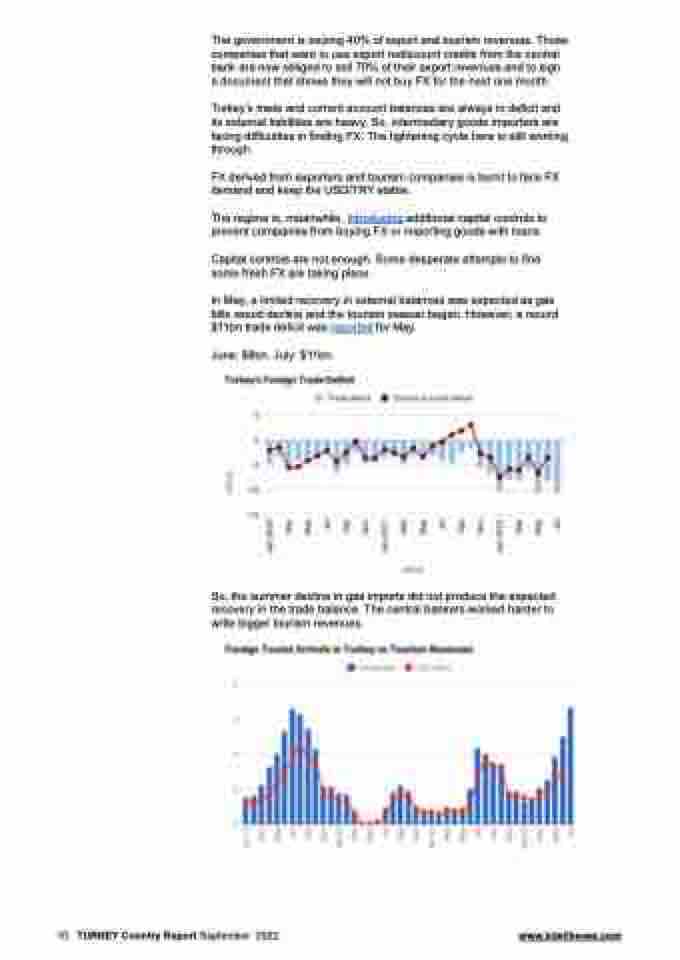

In May, a limited recovery in external balances was expected as gas bills would decline and the tourism season began. However, a record $11bn trade deficit was reported for May.

June: $8bn. July: $11bn.

So, the summer decline in gas imports did not produce the expected recovery in the trade balance. The central bankers worked harder to write bigger tourism revenues.

10 TURKEY Country Report September 2022 www.intellinews.com