Page 4 - AfrOil Week 08 2021

P. 4

AfrOil COMMENTARY AfrOil

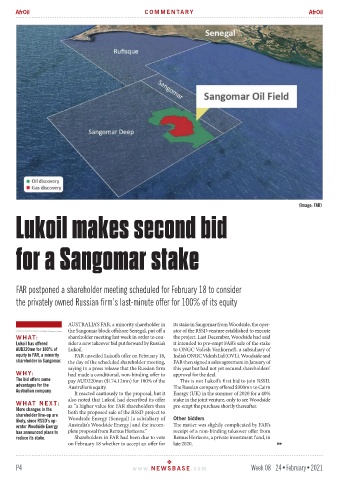

(Image: FAR)

(Image: F AR)

Lukoil makes second bid

for a Sangomar stake

FAR postponed a shareholder meeting scheduled for February 18 to consider

the privately owned Russian firm’s last-minute offer for 100% of its equity

AUSTRALIA’S FAR, a minority shareholder in its stake in Sangomar from Woodside, the oper-

the Sangomar block offshore Senegal, put off a ator of the RSSD venture established to execute

WHAT: shareholder meeting last week in order to con- the project. Last December, Woodside had said

Lukoil has offered sider a new takeover bid put forward by Russia’s it intended to pre-empt FAR’s sale of the stake

AUD220mn for 100% of Lukoil. to ONGC Videsh Vankorneft, a subsidiary of

equity in FAR, a minority FAR unveiled Lukoil’s offer on February 18, India’s ONGC Videsh Ltd (OVL). Woodside and

shareholder in Sangomar. the day of the scheduled shareholder meeting, FAR then signed a sales agreement in January of

saying in a press release that the Russian firm this year but had not yet secured shareholders’

WHY: had made a conditional, non-binding offer to approval for the deal.

The bid offers some pay AUD220mn ($174.12mn) for 100% of the This is not Lukoil’s first bid to join RSSD.

advantages for the Australian’s equity. The Russian company offered $300mn to Cairn

Australian company. It reacted cautiously to the proposal, but it Energy (UK) in the summer of 2020 for a 40%

also noted that Lukoil had described its offer stake in the joint venture, only to see Woodside

WHAT NEXT: as “a higher value for FAR shareholders than pre-empt the purchase shortly thereafter.

More changes in the both the proposed sale of the RSSD project to

shareholder line-up are

likely, since RSSD’s op- Woodside Energy (Senegal) [a subsidiary of Other bidders

erator Woodside Energy Australia’s Woodside Energy] and the incom- The matter was slightly complicated by FAR’s

has announced plans to plete proposal from Remus Horizons.” receipt of a non-binding takeover offer from

reduce its stake. Shareholders in FAR had been due to vote Remus Horizons, a private investment fund, in

on February 18 whether to accept an offer for late 2020.

P4 www. NEWSBASE .com Week 08 24•February•2021