Page 13 - AsianOil Week 30

P. 13

AsianOil OCEANIA AsianOil

Comet mulls Mahalo

Gas Projectstake sale

FINANCE & AUSTRALIAN independent Comet Ridge has It said it had opened talks with potential part-

INVESTMENT said it may sell off some of its 40% stake in the ners in Mahalo North’s development, noting that

Mahalo Gas Project (MGP) in Queensland. the project would capitalise on projected supply

The company said on July 30 that a par- shortfalls on the East Coast gas market. The

tial divestment would not only help it to meet Australian Energy Market Operator (AEMO)

its equity funding obligations, but would also has warned that domestic gas supply shortages

pave the way for it to focus on its wholly owned could emerge in Victoria by 2023, with other

Mahalo North block. neighbouring states to experience a similar

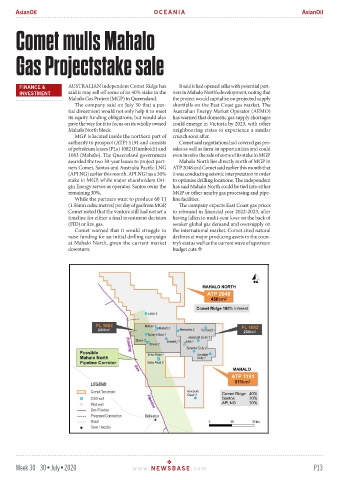

MGP is located inside the northern part of crunch soon after.

authority to prospect (ATP) 1191 and consists Comet said negotiations had covered gas pre-

of petroleum leases (PLs) 1082 (Humboldt) and sales as well as farm-in opportunities and could

1083 (Mahalo). The Queensland government even involve the sale of some of its stake in MGP.

awarded the two 30-year leases to project part- Mahalo North lies directly north of MGP in

ners Comet, Santos and Australia Pacific LNG ATP 2048 and Comet said earlier this month that

(APLNG) earlier this month. APLNG has a 30% it was conducting seismic interpretation in order

stake in MGP, while major shareholders Ori- to optimise drilling locations. The independent

gin Energy serves as operator. Santos owns the has said Mahalo North could be tied into either

remaining 30%, MGP or other nearby gas processing and pipe-

While the partners want to produce 60 TJ line facilities.

(1.56mn cubic metres) per day of gas from MGP, The company expects East Coast gas prices

Comet noted that the venture still had not set a to rebound in financial year 2022-2023, after

timeline for either a final investment decision having fallen to multi-year lows on the back of

(FID) or first gas. weaker global gas demand and oversupply on

Comet warned that it would struggle to the international market. Comet cited natural

raise funding for an initial drilling campaign declines at major producing assets in the coun-

at Mahalo North, given the current market try’s east as well as the current wave of upstream

downturn. budget cuts.

Week 30 30•July•2020 www. NEWSBASE .com P13