Page 128 - RusRPTApr23

P. 128

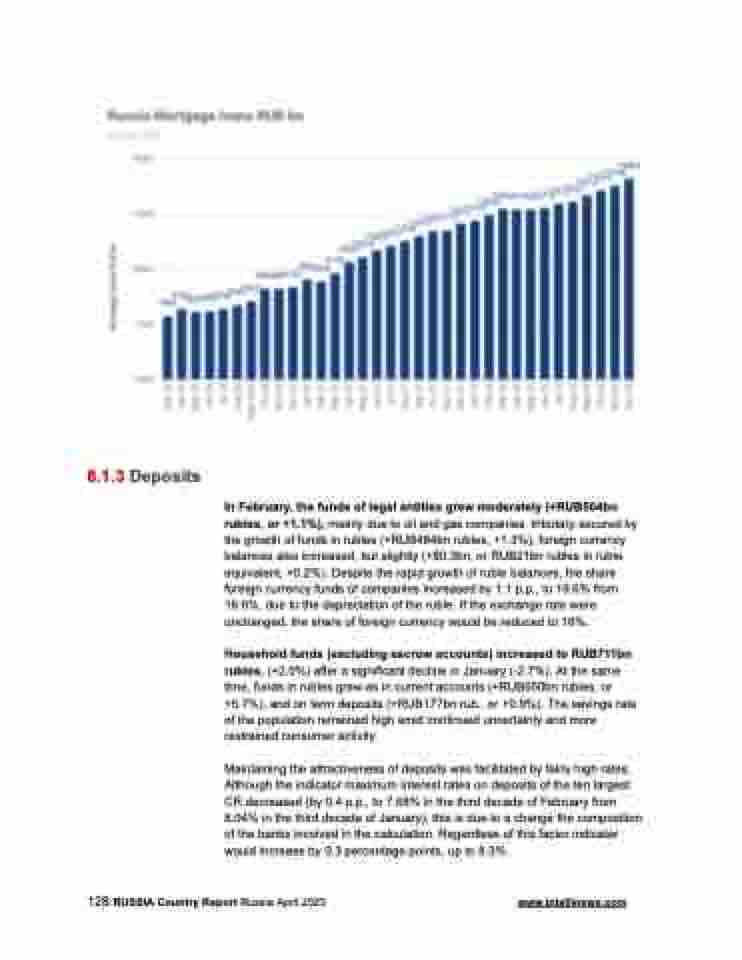

8.1.3 Deposits

In February, the funds of legal entities grew moderately (+RUB504bn rubles, or +1.1%), mainly due to oil and gas companies. tributary secured by the growth of funds in rubles (+RUB484bn rubles, +1.3%), foreign currency balances also increased, but slightly (+$0.3bn, or RUB21bn rubles in ruble equivalent, +0.2%). Despite the rapid growth of ruble balances, the share foreign currency funds of companies increased by 1.1 p.p., to 19.6% from 18.6%, due to the depreciation of the ruble. If the exchange rate were unchanged, the share of foreign currency would be reduced to 18%.

Household funds (excluding escrow accounts) increased to RUB711bn rubles. (+2.0%) after a significant decline in January (-2.7%). At the same time, funds in rubles grew as in current accounts (+RUB650bn rubles, or +5.7%), and on term deposits (+RUB177bn rub., or +0.9%). The savings rate of the population remained high amid continued uncertainty and more restrained consumer activity.

Maintaining the attractiveness of deposits was facilitated by fairly high rates. Although the indicator maximum interest rates on deposits of the ten largest CR decreased (by 0.4 p.p., to 7.68% in the third decade of February from 8.04% in the third decade of January), this is due to a change the composition of the banks involved in the calculation. Regardless of this factor indicator would increase by 0.3 percentage points, up to 8.3%.

128 RUSSIA Country Report Russia April 2023 www.intellinews.com