Page 129 - RusRPTApr23

P. 129

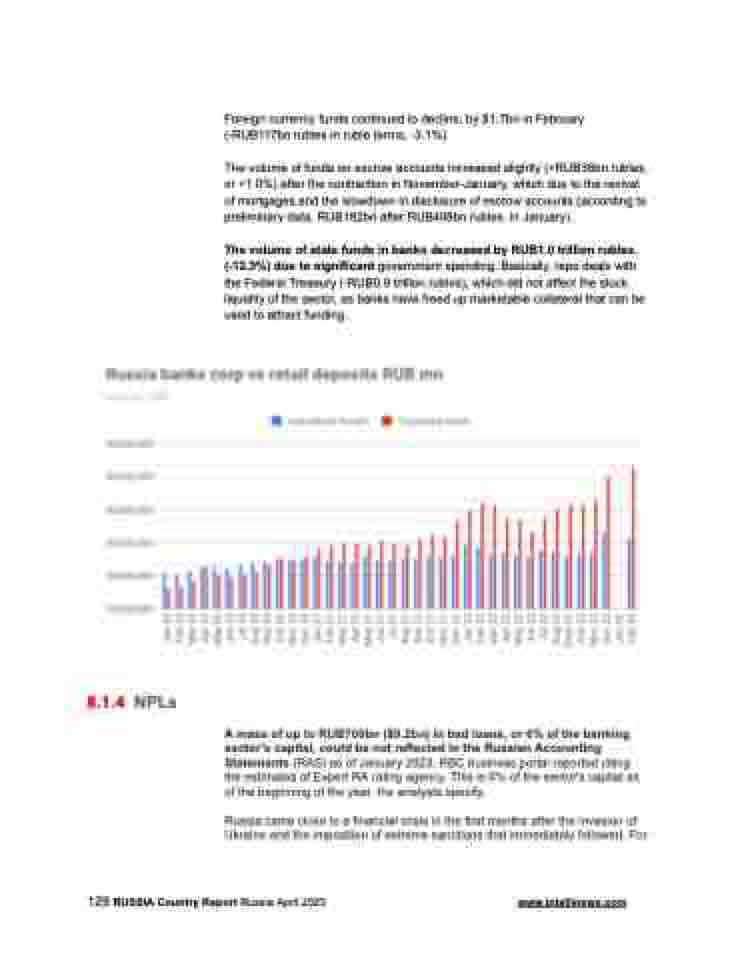

Foreign currency funds continued to decline, by $1.7bn in February (-RUB117bn rubles in ruble terms, -3.1%).

The volume of funds on escrow accounts increased slightly (+RUB38bn rubles, or +1.0%) after the contraction in November-January, which due to the revival of mortgages and the slowdown in disclosure of escrow accounts (according to preliminary data, RUB182bn after RUB408bn rubles. in January).

The volume of state funds in banks decreased by RUB1.0 trillion rubles. (-12.3%) due to significant government spending. Basically, repo deals with the Federal Treasury (-RUB0.9 trillion rubles), which did not affect the stock liquidity of the sector, as banks have freed up marketable collateral that can be used to attract funding.

8.1.4 NPLs

A mass of up to RUB700bn ($9.2bn) in bad loans, or 6% of the banking sector’s capital, could be not reflected in the Russian Accounting Statements (RAS) as of January 2023, RBC business portal reported citing the estimates of Expert RA rating agency. This is 6% of the sector's capital as of the beginning of the year, the analysts specify.

Russia came close to a financial crisis in the first months after the invasion of Ukraine and the imposition of extreme sanctions that immediately followed. For

129 RUSSIA Country Report Russia April 2023 www.intellinews.com