Page 82 - bne Magazine August 2022

P. 82

82 Opinion

bne August 2022

NEMETHY

The riskiest macroeconomic environment of the 21st Century!

Les Nemethy CEO and founder of Euro-Phoenix Les Nemethy CEO and founder of Euro-Phoenix Financial Advisors Financial Advisors

In my opinion, the macro environment is riskier than before the Dotcom Bubble and before the Great Financial Bubble. Why? A nasty cocktail of factors which may reinforce each other:

• Jerome Powell declared he wants to see a trend of lower consumer price index (CPI) data before the Fed takes the foot off the monetary tightening pedal. The Fed calling itself “data dependent” is like driving using the rear view mirror. The Fed intends to continue to raise interest rates until data, which is by definition lagged, shows

a favourable CPI trend.

• What if raising interest rates kills demand, but not

inflation? Then the Fed continues to tighten, literally

until something breaks.

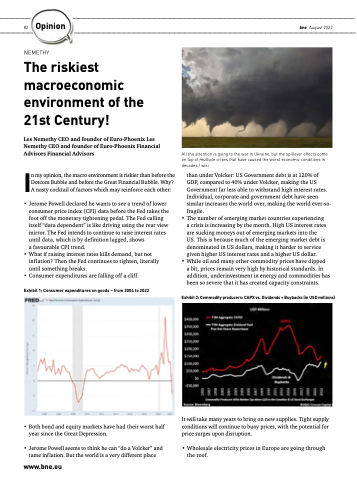

• Consumer expenditures are falling off a cliff.

Exhibit 1: Consumer expenditures on goods – from 2004 to 2022

• Both bond and equity markets have had their worst half year since the Great Depression.

• Jerome Powell seems to think he can “do a Volcker” and tame inflation. But the world is a very different place

www.bne.eu

All the attention is going to the war in Ukraine, but the spillover effects come on top of multiple crises that have caused the worst economic conditions in decades / wiki

than under Volcker: US Government debt is at 120% of GDP, compared to 40% under Volcker, making the US Government far less able to withstand high interest rates. Individual, corporate and government debt have seen similar increases the world over, making the world ever-so- fragile.

• The number of emerging market countries experiencing a crisis is increasing by the month. High US interest rates are sucking moneys out of emerging markets into the US. This is because much of the emerging market debt is denominated in US dollars, making it harder to service given higher US interest rates and a higher US dollar.

• While oil and many other commodity prices have dipped

a bit, prices remain very high by historical standards. In addition, underinvestment in energy and commodities has been so severe that it has created capacity constraints.

Exhibit 2: Commodity producers: CAPX vs. Dividends + Buybacks (in USD millions)

It will take many years to bring on new supplies. Tight supply conditions will continue to buoy prices, with the potential for price surges upon disruption.

• Wholesale electricity prices in Europe are going through the roof.