Page 67 - RusRPTJul23

P. 67

inflation (13.8%).

Considering that Russian energy exports grew by 43% in a favourable environment (to $384bn, according to the Federal Customs Service), such dynamics can be almost completely explained by sanctions pressure and the accompanying increase in production and logistics costs, RUBC experts say. Inflation, forced reorientation to domestic suppliers and improved revenue accounting by the Federal Tax Service are secondary against this background.

The Federal Tax Service calculates profits differently than Rosstat, which summarizes the balanced financial result - profits minus losses of Russian companies, excluding banks and small businesses, based on financial statements. The latter fell by 12.6% last year to RUB25.9 trillion.

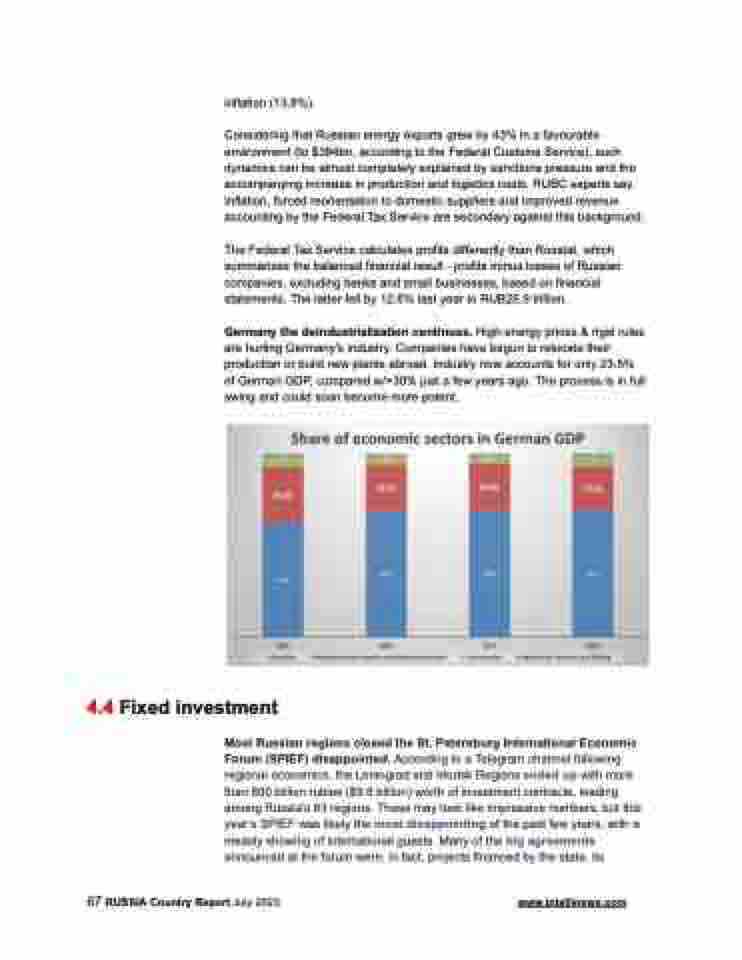

Germany the deindustrialization continues. High energy prices & rigid rules are hurting Germany's industry. Companies have begun to relocate their production or build new plants abroad. Industry now accounts for only 23.5% of German GDP, compared w/>30% just a few years ago. The process is in full swing and could soon become more potent.

4.4 Fixed investment

Most Russian regions closed the St. Petersburg International Economic Forum (SPIEF) disappointed. According to a Telegram channel following regional economics, the Leningrad and Irkutsk Regions ended up

big agreements

with more

than 800 billion rubles ($9.6 billion) worth of investment contracts, leading

among Russia’s 83 regions. These may look like impressive numbers, but this

year’s SPIEF was likely the

measly showing of international guests. Many of the

most disappointing

of the past few years, with a

announced at the forum were, in fact, projects financed by the state, its

67 RUSSIA Country Report July 2023 www.intellinews.com