Page 10 - AsianOil Week 48 2020

P. 10

AsianOil OCEANIA AsianOil

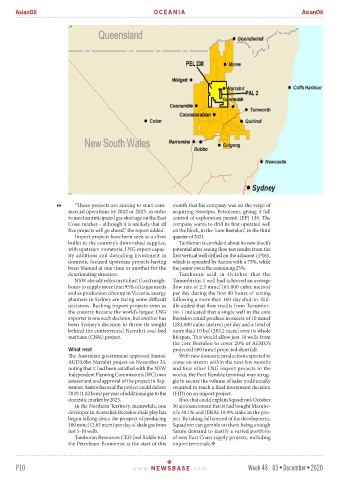

“These projects are aiming to start com- month that his company was on the verge of

mercial operations by 2022 or 2023, in order acquiring Sweetpea Petroleum, giving it full

to meet an anticipated gas shortage on the East control of exploration permit (EP) 136. The

Coast market – although it is unlikely that all company wants to drill its first operated well

five projects will go ahead,” the report added. on the block, in the “core Beetaloo”, in the third

Import projects have been seen as a silver quarter of 2021.

bullet to the country’s diminished supplies, Tamboran is confident about its new block’s

with upstream moratoria, LNG export capac- potential after seeing flow test results from the

ity additions and dwindling investment in first vertical well drilled on the adjacent EP161,

domestic focused upstream projects having which is operated by Santos with a 75%, while

been blamed at one time or another for the the junior owns the remaining 25%.

deteriorating situation. Tamboran said in October that the

NSW already relies on its East Coast neigh- Tanumbirini-1 well had achieved an average

bours to supply more than 95% of its gas needs flow rate of 2.3 mmcf (65,000 cubic metres)

and as production dries up in Victoria, energy per day during the first 90 hours of testing

planners in Sydney are facing some difficult following a more than 160-day shut-in. Rid-

decisions. Backing import projects even as dle added that flow results from Tanumbir-

the country became the world’s largest LNG ini-1 indicated that a single well in the core

exporter is one such decision, but another has Beetaloo could produce in excess of 10 mmcf

been Sydney’s decision to throw its weight (283,000 cubic metres) per day and a total of

behind the controversial Narrabri coal-bed more than 10 bcf (283.2 mcm) over its whole

methane (CBM) project. lifespan. This would allow just 10 wells from

the core Beetaloo to cover 20% of AEMO’s

What next projected 500 mmcf projected shortfall.

The Australian government approved Santos’ With new domestic production expected to

AUD3.6bn Narrabri project on November 24, come on stream within the next few months

noting that it had been satisfied with the NSW and four other LNG import projects in the

Independent Planning Commission’s (IPC) own works, the Port Kembla terminal may strug-

assessment and approval of the project in Sep- gle to secure the volume of sales traditionally

tember. Santos has said the project could deliver required to reach a final investment decision

70 PJ (1.82 bcm) per year of additional gas to the (FID) on an import project.

domestic market by 2023. If so, that could explain Squadron’s October

In the Northern Territory, meanwhile, one 30 announcement that it had bought Marube-

developer in Australia’s Beetaloo shale play has ni’s 30.1% and JERA’s 19.9% stake in the pro-

begun talking about the prospect of producing ject. By taking full control of the development,

100 mmcf (2.83 mcm) per day of shale gas from Squadron can gamble on there being enough

just 5-10 wells. future demand to justify a varied portfolio

Tamboran Resources CEO Joel Riddle told of new East Coast supply projects, including

the Petroleum Economist at the start of this import terminals.

P10 www. NEWSBASE .com Week 48 03•December•2020