Page 22 - Caucasus Outlook 2024

P. 22

signifies investor confidence in the long-term prospects of the Azerbaijani economy.

Declining oil production remains a major concern, raising questions about the sustainability of future economic growth and government revenues heavily reliant on oil and gas exports.

High inflation, reaching 14.4% in November 2023, significantly eroded household incomes and purchasing power, potentially dampening consumer spending and impacting overall economic activity.

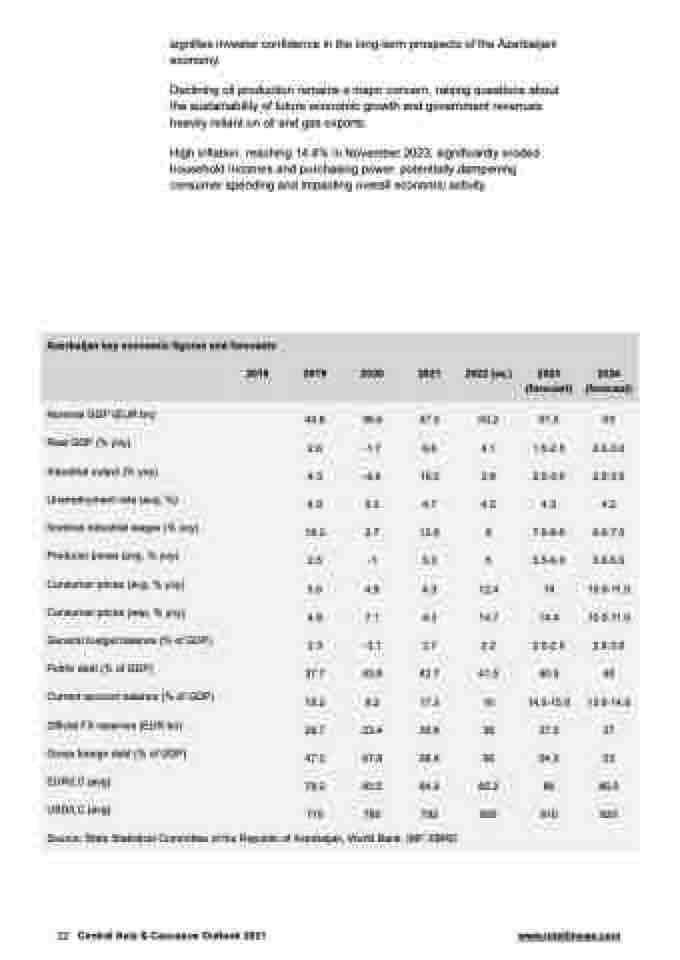

Azerbaijan key economic figures and forecasts

2018 2019 2020 2021 2022 (es.) 2023 2024 (forecast) (forecast)

Nominal GDP (EUR bn)

44.8 38.4 47.3 50.2 51.5 53

Real GDP (% yoy)

2.6 -1.7 6.6 4.1 1.5-2.5 2.0-3.0

Industrial output (% yoy)

4.3 -6.6 10.5 3.8 2.0-3.0 2.5-3.5

Unemployment rate (avg, %)

4.9 5.3 4.7 4.5 4.3 4.2

Nominal industrial wages (% yoy)

10.2 2.7 12.6 9 7.0-8.0 6.0-7.0

Producer prices (avg, % yoy)

2.5 -1 5.3 5 5.5-6.0 5.0-5.5

Consumer prices (avg, % yoy)

3.6 4.9 4.3 12.4 14 10.0-11.0

Consumer prices (eop, % yoy)

4.8 7.1 4.3 14.7 14.4 10.0-11.0

General budget balance (% of GDP)

2.3 -3.1 2.7 2.2 2.0-2.5 2.5-3.0

Public debt (% of GDP)

37.7 43.8 42.7 41.5 40.5 40

Current account balance (% of GDP)

15.2 9.2 17.3 16 14.0-15.0 13.0-14.0

Official FX reserves (EUR bn)

29.7 23.4 35.8 38 37.5 37

Gross foreign debt (% of GDP)

47.2 67.8 58.4 56 54.5 53

EUR/LC (avg)

79.2 83.5 84.3 85.2 86 86.5

USD/LC (avg)

Source: State Statistical Committee of the Republic of Azerbaijan, World Bank, IMF, EBRD

710 780 782 800 810 820

22 Central Asia & Caucasus Outlook 2021 www.intellinews.com