Page 105 - Russia OUTLOOK 2024

P. 105

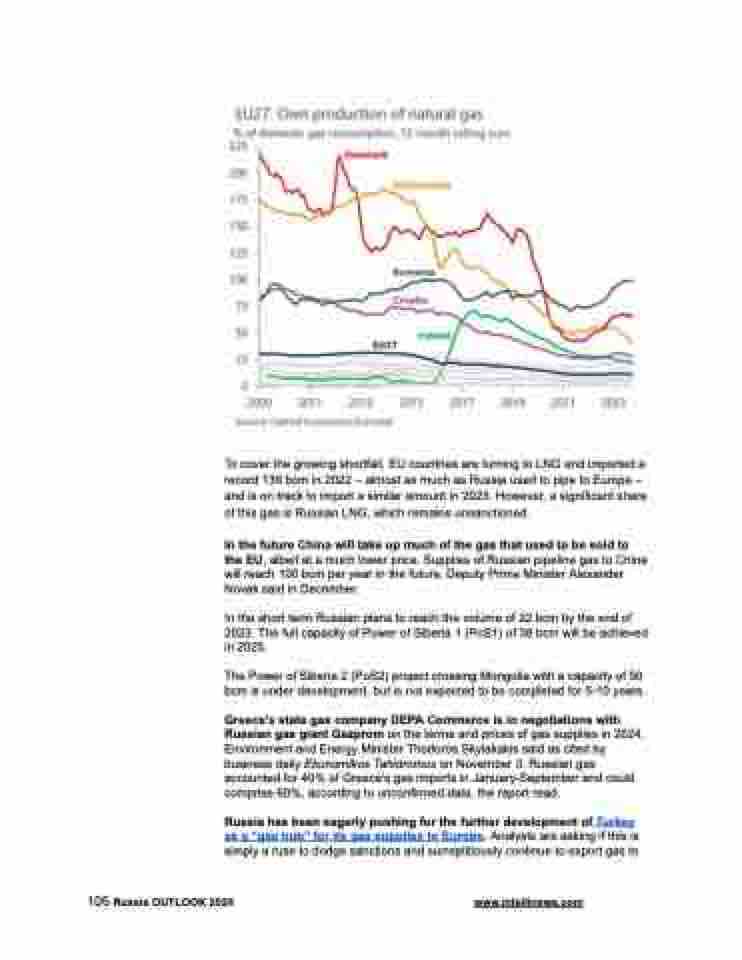

To cover the growing shortfall, EU countries are turning to LNG and imported a record 130 bcm in 2022 – almost as much as Russia used to pipe to Europe – and is on track to import a similar amount in 2023. However, a significant share of this gas is Russian LNG, which remains unsanctioned.

In the future China will take up much of the gas that used to be sold to the EU, albeit at a much lower price. Supplies of Russian pipeline gas to China will reach 100 bcm per year in the future, Deputy Prime Minister Alexander Novak said in December.

In the short term Russian plans to reach the volume of 22 bcm by the end of 2023. The full capacity of Power of Siberia 1 (PoS1) of 38 bcm will be achieved in 2025.

The Power of Siberia 2 (PoS2) project crossing Mongolia with a capacity of 50 bcm is under development, but is not expected to be completed for 5-10 years.

Greece's state gas company DEPA Commerce is in negotiations with Russian gas giant Gazprom on the terms and prices of gas supplies in 2024, Environment and Energy Minister Thodoros Skylakakis said as cited by business daily Ekonomikos Tahidromos on November 3. Russian gas accounted for 40% of Greece's gas imports in January-September and could comprise 60%, according to unconfirmed data, the report read.

Russia has been eagerly pushing for the further development of Turkey as a “gas hub” for its gas supplies to Europe. Analysts are asking if this is simply a ruse to dodge sanctions and surreptitiously continue to export gas to

105 Russia OUTLOOK 2024 www.intellinews.com