Page 62 - bne IntelliNews monthly magazine December 2024

P. 62

62 Opinion

bne December 2024

has announced that it will close three German plants for

the first time in its 87-year history and Audi, a Volkswagen subsidiary, announced it will cut 15% of its workforce on November 8. The European car market is under increasing pressure from Chinese imports and is also intending to erect a tariff barrier to protect its own carmakers as the price crisis filters through from heavy industry and starts to impact consumption.

Recent data shows little sign of relief for the industrial sector, according to Oxford Economics, which has been contracting throughout 2023. The latest September figures show another sharp decline in German production, traditionally the engine of European growth.

Although the recent third quarter GDP figures provided a positive surprise, the broader indicators – such as the PMI data in October – are less encouraging.

“The industrial sector is mired in a slump, particularly in Germany. Although short-term prospects remain negative, we anticipate a modest recovery in 2025 if monetary easing begins to feed through,” Talavera said. However, this potential upturn could be undercut if early elections fail to yield a stable government committed to structural reforms.

Looking forward, the 2025 German elections could define the trajectory of Europe’s largest economy. If a new coalition manages to coalesce around much-needed economic reforms, particularly the controversial public debt brake, Germany might finally see a much-needed policy reset. But much will depend on whether the likely favourite Christian Democratic Union (CDU) party, currently leading in polls, will pursue reform or maintain fiscal conservatism.

The other wild card in the German vote is the FDP is unlikely to clear the 5% threshold and will not be represented in the Bundestag. The Greens are also likely to see their support fall, while the right wing AfD (Alternative für Deutschland), which recently shocked with first time wins in regional elections, could improve its hand further.

Europe’s near-term outlook remains clouded by uncertainty – Trump’s hallmark – and shifting political landscapes on both sides of the Atlantic.

The New York Times poignantly observed in its wrap of the US elections: “Now Americans will have to come to terms with the fact that Trump's first presidency was not a random four- year period, but the opening of a 12-year era of Trump.” The EU will have to wake up to the same reality.

How to awaken Europe's private sector and boost economic growth

IMF

The recent report from former Italian Prime Minister and ex-European Central Bank boss Mario Draghi painted a bleak picture for Europe’s future. It has fallen badly behind the US and is facing an increasingly strong challenge from the rising Global South economies after it lost its competitive edge. Draghi says that the EU needs to invest over €800bn a year to catch up – more money than was spent on the post-WWII reconstruction. Diego Cerdeiro, Gee Hee Hong, and Alfred Kammer wrote a blog for the International Monetary Fund (IMF) on what needs to be done to revitalise Europe’s economy.

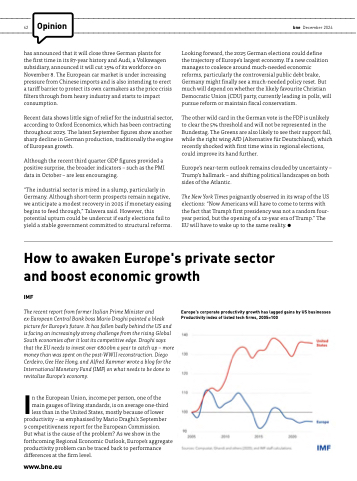

In the European Union, income per person, one of the main gauges of living standards, is on average one-third less than in the United States, mostly because of lower productivity – as emphasised by Mario Draghi’s September

9 competitiveness report for the European Commission.

But what is the cause of the problem? As we show in the forthcoming Regional Economic Outlook, Europe's aggregate productivity problem can be traced back to performance differences at the firm level.

www.bne.eu

Europe's corporate productivity growth has lagged gains by US businesses Productivity index of listed tech firms, 2005=100