Page 40 - bneMagazine March 2023 oil discount

P. 40

40 I Special focus I One Year On bne March 2023

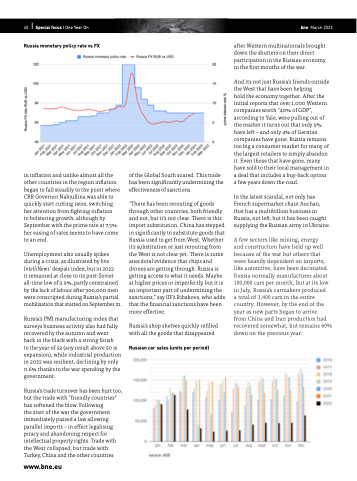

Russia monetary policy rate vs FX

after Western multinationals brought down the shutters on their direct participation in the Russian economy in the first months of the war.

And its not just Russia’s friends outside the West that have been helping

hold the economy together. After the initial reports that over 1,000 Western companies worth “40% of GDP”, according to Yale, were pulling out of the market it turns out that only 9% have left – and only 4% of German companies have gone. Russia remains too big a consumer market for many of the largest retailers to simply abandon it. Even those that have gone, many have sold to their local management in a deal that includes a buy-back option a few years down the road.

In the latest scandal, not only has French supermarket chain Auchan, that has a multibillion business in Russia, not left, but it has been caught supplying the Russian army in Ukraine.

A few sectors like mining, energy

and construction have held up well because of the war but others that were heavily dependent on imports, like automitve, have been decimated. Russia normally manufactures about 100,000 cars per month, but at its low in July, Russia's carmakers produced

a total of 3,400 cars in the entire country. However, by the end of the year as new parts began to arrive

from China and Iran production had recovered somewhat, but remains 60% down on the previous year.

in inflation and unlike almost all the other countries in the region inflation began to fall steadily to the point where CBR Governor Nabiullina was able to quickly start cutting rates, switching her attention from fighting inflation

to bolstering growth, although by September with the prime rate at 7.5% her easing of rates seems to have come to an end.

Unemployment also usually spikes during a crisis, as illustrated by bne IntelliNews’ despair index, but in 2022

it remained at close to its post-Soviet all-time low of 3.9%, partly constrained by the lack of labour after 300,000 men were conscripted during Russia’s partial mobilisation that started on September 21.

Russia’s PMI manufacturing index that surveys business activity also had fully recovered by the autumn and went back in the black with a strong finish

to the year of 53 (any result above 50 is expansion), while industrial production in 2022 was resilient, declining by only 0.6% thanks to the war spending by the government.

Russia’s trade turnover has been hurt too, but the trade with “friendly countries” has softened the blow. Following

the start of the war the government immediately passed a law allowing parallel imports – in effect legalising piracy and abandoning respect for intellectual property rights. Trade with the West collapsed, but trade with Turkey, China and the other countries

www.bne.eu

of the Global South soared. This trade has been significantly undermining the effectiveness of sanctions.

“There has been rerouting of goods through other countries, both friendly and not, but it’s not clear. There is this import substitution. China has stepped in significantly to substitute goods that Russia used to get from West. Whether it's substitution or just rerouting from the West is not clear yet. There is some anecdotal evidence that chips and drones are getting through. Russia is getting access to what it needs. Maybe at higher prices or imperfectly, but it is an important part of undermining the sanctions,” say IIF's Ribakova, who adds that the financial sanctions have been more effective.

Russia’s shop shelves quickly refilled with all the goods that disappeared

Russian car sales (units per period)