Page 54 - Mission Brief Qatar 2019 v2

P. 54

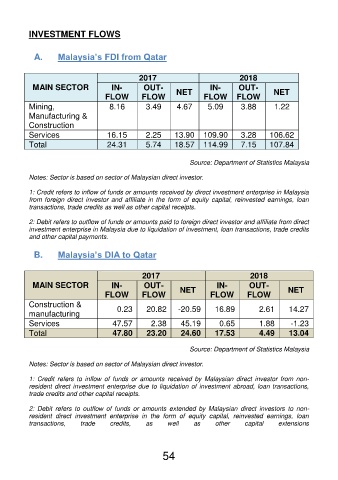

INVESTMENT FLOWS

A. Malaysia’s FDI from Qatar

2017 2018

MAIN SECTOR IN- OUT- NET IN- OUT- NET

FLOW FLOW FLOW FLOW

Mining, 8.16 3.49 4.67 5.09 3.88 1.22

Manufacturing &

Construction

Services 16.15 2.25 13.90 109.90 3.28 106.62

Total 24.31 5.74 18.57 114.99 7.15 107.84

Source: Department of Statistics Malaysia

Notes: Sector is based on sector of Malaysian direct investor.

1: Credit refers to inflow of funds or amounts received by direct investment enterprise in Malaysia

from foreign direct investor and affiliate in the form of equity capital, reinvested earnings, loan

transactions, trade credits as well as other capital receipts.

2: Debit refers to outflow of funds or amounts paid to foreign direct investor and affiliate from direct

investment enterprise in Malaysia due to liquidation of investment, loan transactions, trade credits

and other capital payments.

B. Malaysia’s DIA to Qatar

2017 2018

MAIN SECTOR IN- OUT- NET IN- OUT- NET

FLOW FLOW FLOW FLOW

Construction & 0.23 20.82 -20.59 16.89 2.61 14.27

manufacturing

Services 47.57 2.38 45.19 0.65 1.88 -1.23

Total 47.80 23.20 24.60 17.53 4.49 13.04

Source: Department of Statistics Malaysia

Notes: Sector is based on sector of Malaysian direct investor.

1: Credit refers to inflow of funds or amounts received by Malaysian direct investor from non-

resident direct investment enterprise due to liquidation of investment abroad, loan transactions,

trade credits and other capital receipts.

2: Debit refers to outflow of funds or amounts extended by Malaysian direct investors to non-

resident direct investment enterprise in the form of equity capital, reinvested earnings, loan

transactions, trade credits, as well as other capital extensions

54