Page 34 - Noble's Basic Industries Virtual Equity Conference 2024

P. 34

Energy

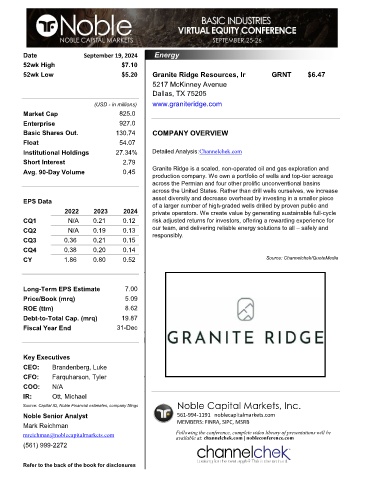

Date September 19, 2024 Energy

52wk High $7.10

52wk Low $5.20 Granite Ridge Resources, In GRNT $6.47

5217 McKinney Avenue

Dallas, TX 75205

(USD - in millions) www.graniteridge.com

Market Cap 825.0

Enterprise 927.0

Basic Shares Out. 130.74 COMPANY OVERVIEW

Float 54.07

Institutional Holdings 27.34% Detailed Analysis:Channelchek.com

Short Interest 2.79

Avg. 90-Day Volume 0.45 Granite Ridge is a scaled, non-operated oil and gas exploration and

production company. We own a portfolio of wells and top-tier acreage

across the Permian and four other prolific unconventional basins

across the United States. Rather than drill wells ourselves, we increase

EPS Data asset diversity and decrease overhead by investing in a smaller piece

of a larger number of high-graded wells drilled by proven public and

2022 2023 2024 private operators. We create value by generating sustainable full-cycle

CQ1 N/A 0.21 0.12 risk adjusted returns for investors, offering a rewarding experience for

CQ2 N/A 0.19 0.13 our team, and delivering reliable energy solutions to all – safely and

responsibly.

CQ3 0.36 0.21 0.15

CQ4 0.38 0.20 0.14

CY 1.86 0.80 0.52 Source: Channelchek/QuoteMedia

Long-Term EPS Estimate 7.00

Price/Book (mrq) 5.09

ROE (ttm) 8.62

Debt-to-Total Cap. (mrq) 19.87

Fiscal Year End 31-Dec

5217 McKinne Dallas TX 75205

Key Executives

CEO: Brandenberg, Luke

CFO: Farquharson, Tyler

COO: N/A

IR: Ott, Michael

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Mark Reichman MEMBERS: FINRA, SIPC, MSRB

mreichman@noblecapitalmarkets.com Following the conference, complete video library of presentations will be

available at: channelchek.com | nobleconference.com

(561) 999-2272

Refer to the back of the book for disclosures