Page 140 - NobleCon20-Book-Project

P. 140

Health Care

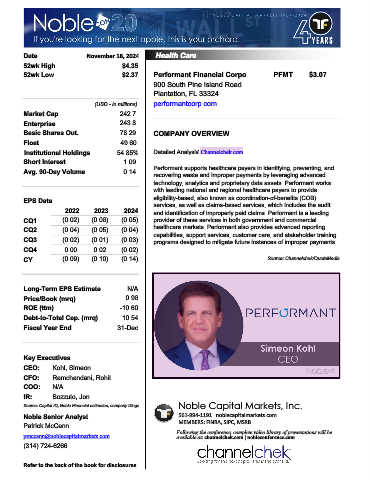

Date November 18, 2024 Health Care

52wk High $4.35

52wk Low $2.37 Performant Financial Corpo PFMT $3.07

900 South Pine Island Road

Plantation, FL 33324

(USD - in millions) performantcorp.com

Market Cap 242.7

Enterprise 243.8

Basic Shares Out. 78.29 COMPANY OVERVIEW

Float 49.60

Institutional Holdings 54.85% Detailed Analysis:Channelchek.com

Short Interest 1.09

Avg. 90-Day Volume 0.14 Performant supports healthcare payers in identifying, preventing, and

recovering waste and improper payments by leveraging advanced

technology, analytics and proprietary data assets. Performant works

with leading national and regional healthcare payers to provide

EPS Data eligibility-based, also known as coordination-of-benefits (COB)

services, as well as claims-based services, which includes the audit

2022 2023 2024 and identification of improperly paid claims. Performant is a leading

CQ1 (0.02) (0.06) (0.05) provider of these services in both government and commercial

CQ2 (0.04) (0.05) (0.04) healthcare markets. Performant also provides advanced reporting

capabilities, support services, customer care, and stakeholder training

CQ3 (0.02) (0.01) (0.03) programs designed to mitigate future instances of improper payments.

CQ4 0.00 0.02 (0.02)

CY (0.09) (0.10) (0.14) Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 0.96

ROE (ttm) -10.60

Debt-to-Total Cap. (mrq) 10.54

Fiscal Year End 31-Dec

900 South Pin Plantation FL 33324

Key Executives

CEO: Kohl, Simeon

CFO: Ramchandani, Rohit

COO: N/A

IR: Bozzuto, Jon

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Patrick McCann MEMBERS: FINRA, SIPC, MSRB

Following the conference, complete video library of presentations will be

pmccann@noblecapitalmarkets.com available at: channelchek.com | nobleconference.com

(314) 724-6266

Refer to the back of the book for disclosures