Page 153 - NobleCon20-Book-Project

P. 153

SKYX Platforms Corp.

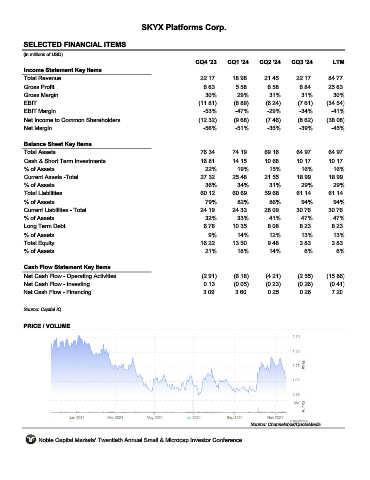

SELECTED FINANCIAL ITEMS SKYX

(in millions of USD)

CQ4 '23 CQ1 '24 CQ2 '24 CQ3 '24 LTM

Income Statement Key Items

Total Revenue 22.17 18.98 21.45 22.17 84.77

Gross Profit 6.63 5.58 6.58 6.84 25.63

Gross Margin 30% 29% 31% 31% 30%

EBIT (11.81) (8.89) (6.24) (7.61) (34.54)

EBIT Margin -53% -47% -29% -34% -41%

Net Income to Common Shareholders (12.32) (9.68) (7.46) (8.62) (38.08)

Net Margin -56% -51% -35% -39% -45%

Balance Sheet Key Items

Total Assets 76.34 74.19 69.16 64.97 64.97

Cash & Short Term Investments 16.81 14.15 10.68 10.17 10.17

% of Assets 22% 19% 15% 16% 16%

Current Assets -Total 27.32 25.48 21.55 18.99 18.99

% of Assets 36% 34% 31% 29% 29%

Total Liabilities 60.12 60.69 59.68 61.14 61.14

% of Assets 79% 82% 86% 94% 94%

Current Liabilities - Total 24.19 24.33 28.09 30.76 30.76

% of Assets 32% 33% 41% 47% 47%

Long Term Debt 6.78 10.35 8.08 8.23 8.23

% of Assets 9% 14% 12% 13% 13%

Total Equity 16.22 13.50 9.48 3.83 3.83

% of Assets 21% 18% 14% 6% 6%

Cash Flow Statement Key Items

Net Cash Flow - Operating Activities (2.91) (6.18) (4.21) (2.55) (15.86)

Net Cash Flow - Investing 0.13 (0.05) (0.23) (0.26) (0.41)

Net Cash Flow - Financing 3.09 3.60 0.25 0.26 7.20

Source: Capital IQ

PRICE / VOLUME

Source: Channelchek/QuoteMedia

Noble Capital Markets' Twentieth Annual Small & Microcap Investor Conference