Page 184 - NobleCon20-Book-Project

P. 184

Information

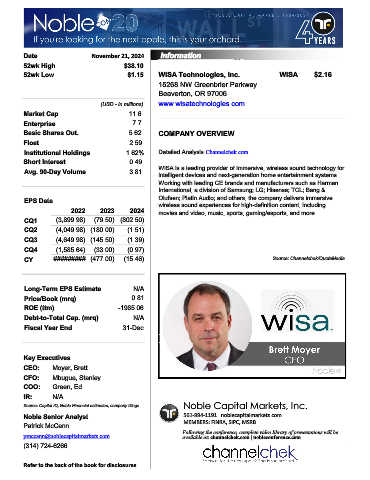

Date November 21, 2024 Information Technology

52wk High $38.10

52wk Low $1.15 WiSA Technologies, Inc. WISA $2.16

15268 NW Greenbrier Parkway

Beaverton, OR 97006

(USD - in millions) www.wisatechnologies.com

Market Cap 11.6

Enterprise 7.7

Basic Shares Out. 5.62 COMPANY OVERVIEW

Float 2.59

Institutional Holdings 1.62% Detailed Analysis:Channelchek.com

Short Interest 0.49

Avg. 90-Day Volume 3.81 WiSA is a leading provider of immersive, wireless sound technology for

intelligent devices and next-generation home entertainment systems.

Working with leading CE brands and manufacturers such as Harman

International, a division of Samsung; LG; Hisense; TCL; Bang &

EPS Data Olufsen; Platin Audio; and others, the company delivers immersive

wireless sound experiences for high-definition content, including

2022 2023 2024 movies and video, music, sports, gaming/esports, and more.

CQ1 (3,899.98) (79.50) (802.50)

CQ2 (4,049.98) (180.00) (1.51)

CQ3 (4,649.98) (145.50) (1.39)

CQ4 (1,585.64) (33.00) (0.97)

CY ######### (477.00) (15.46) Source: Channelchek/QuoteMedia

Long-Term EPS Estimate N/A

Price/Book (mrq) 0.81

ROE (ttm) -1985.06

Debt-to-Total Cap. (mrq) N/A

Fiscal Year End 31-Dec

15268 NW GreBeaverton OR 97006

Key Executives

CEO: Moyer, Brett

CFO: Mbugua, Stanley

COO: Green, Ed

IR: N/A

Noble Capital Markets, Inc.

Source: Capital IQ, Noble Financial estimates, company filings

Noble Senior Analyst 561-994-1191 noblecapitalmarkets.com

Patrick McCann MEMBERS: FINRA, SIPC, MSRB

Following the conference, complete video library of presentations will be

pmccann@noblecapitalmarkets.com available at: channelchek.com | nobleconference.com

(314) 724-6266

Refer to the back of the book for disclosures