Page 19 - Builder Brief June 2021

P. 19

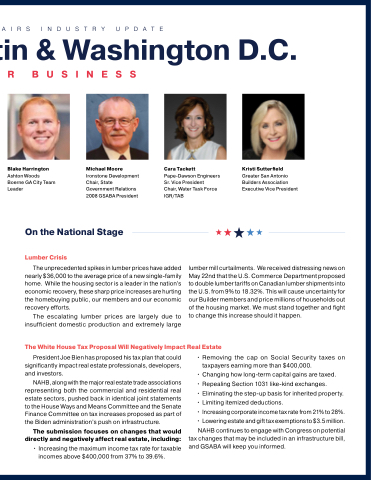

Blake Harrington

Ashton Woods Boerne GA City Team Leader

Michael Moore

Ironstone Development Chair, State Government Relations 2008 GSABA President

Cara Tackett

Pape-Dawson Engineers Sr. Vice President

Chair, Water Task Force IGR/TAB

Kristi Sutterfield

Greater San Antonio Builders Association Executive Vice President

On the National Stage

Lumber Crisis

The unprecedented spikes in lumber prices have added nearly $36,000 to the average price of a new single-family home. While the housing sector is a leader in the nation’s economic recovery, these sharp price increases are hurting the homebuying public, our members and our economic recovery efforts.

The escalating lumber prices are largely due to insufficient domestic production and extremely large

lumber mill curtailments. We received distressing news on May 22nd that the U.S. Commerce Department proposed to double lumber tariffs on Canadian lumber shipments into the U.S. from 9% to 18.32%. This will cause uncertainty for our Builder members and price millions of households out of the housing market. We must stand together and fight to change this increase should it happen.

The White House Tax Proposal Will Negatively Impact Real Estate

President Joe Bien has proposed his tax plan that could significantly impact real estate professionals, developers, and investors.

NAHB, along with the major real estate trade associations representing both the commercial and residential real estate sectors, pushed back in identical joint statements to the House Ways and Means Committee and the Senate Finance Committee on tax increases proposed as part of the Biden administration’s push on infrastructure.

The submission focuses on changes that would directly and negatively affect real estate, including:

• Increasing the maximum income tax rate for taxable incomes above $400,000 from 37% to 39.6%.

• Removing the cap on Social Security taxes on taxpayers earning more than $400,000.

• Changing how long-term capital gains are taxed.

• Repealing Section 1031 like-kind exchanges.

• Eliminating the step-up basis for inherited property. • Limiting itemized deductions.

• Increasingcorporateincometaxratefrom21%to28%. • Loweringestateandgifttaxexemptionsto$3.5million.

NAHB continues to engage with Congress on potential tax changes that may be included in an infrastructure bill, and GSABA will keep you informed.