Page 20 - 2025 Housing Forecast

P. 20

20

2025 HOUSING FORECAST

National

Economic Update

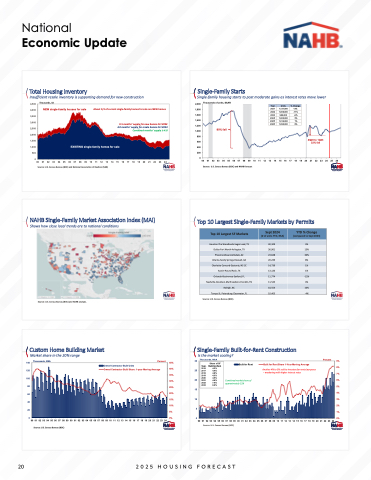

Total Housing Inventory

Insufficient resale inventory is supporting demand for new construction

Single-Family Starts

Single-family housing starts to post moderate gains as interest rates move lower

4,500 4,000 3,500 3,000 2,500 2,000 1,500 1,000

500 0

Thousands, SA

NEW single-family houses for sale

About 1/3 of current single-family homes for sale are NEW homes

9.5 months’ supply for new homes Oct 2024

4.0 months’ supply for resale homes Oct 2024

Combined months’ supply is 4.8

2,000 1,800 1,600 1,400 1,200 1,000

800 600 400 200

Thousands of units, SAAR

80% fall

Year 2021 2022 2023 2024f 2025f 2026f

Units 1,131,000 1,006,000 949,000 1,000,000 1,014,000 1,090,000

% Change 13% -11% -6% 5% 1% 8%

EXISTING single-family homes for sale

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Source: U.S. Census Bureau (BOC) and National Association of Realtors (NAR)

0

00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

NAHB Single-Family Market Association Index (MAI) Shows how close local trends are to national conditions

Source: U.S. Census Bureau (BOC) and NAHB analysis.

Custom Home Building Market Market share in the 20% range

Source: U.S. Census Bureau (BOC) and NAHB forecast

Top 10 Largest Single-Family Markets by Permits

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Source: U.S. Census Bureau (BOC)

90

91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Source: U.S. Census Bureau (BOC)

5

6% 5% 4% 3% 2% 1% 0%

Top 10 Largest SF Markets

Houston-The Woodlands-Sugar Land, TX Dallas-Fort Worth-Arlington, TX Phoenix-Mesa-Scottsdale, AZ Atlanta-Sandy Springs-Roswell, GA Charlotte-Concord-Gastonia, NC-SC Austin-Round Rock, TX Orlando-Kissimmee-Sanford, FL Nashville-Davidson-Murfreesboro-Franklin, TN Raleigh, NC

Tampa-St. Petersburg-Clearwater, FL

Source: U.S. Census Bureau (BOC).

Sept 2024

(# of units YTD, NSA)

40,109 36,961 23,648 20,239 14,739 13,120 11,774 11,543 10,554 10,463

YTD % Change (compared to Sept 2023)

3% 15% 30% 8% 1% 1% -12% 4% 10% -4%

4Q20 to 1Q23 32% fall

140 120 100 80 60 40 20

0

Thousands, NSA

Percent 45% Owner/Contractor Built Share: 1-year Moving Average 40%

30 25 20 15 10

Single-Family Built-for-Rent Construction Is the market cooling?

Thousands, NSA

Percent 9% 8%

Owner/Contractor Built Units

Share of SF Year Built for Rent

2016 4.3%

2017 4.4%

2018 4.8%

2019 4.3%

2020 4.5%

2021 4.6%

2022 7.0%

2023 8.2%

Built for Rent

Combined market share of approximately 12%

Built for Rent Share 1-Year Moving Average

35%

30%

25%

20%

15%

10%

5% 0%0

Another 4% to 5% sold to investors for rental purposes

– weakening with higher interest rates 7%