Page 7 - 28 North Hollow Presentation

P. 7

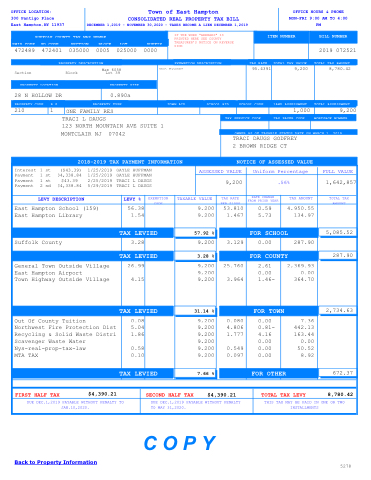

OFFICE LOCATION:

300 Pantigo Place

East Hampton,NY 11937

Town of East Hampton

CONSOLIDATED REAL PROPERTY TAX BILL DECEMBER 1,2019 - NOVEMBER 30,2020 - TAXES BECOME A LIEN DECEMBER 1,2019

OFFICE HOURS & PHONE

MON-FRI 9:00 AM TO 4:00

PM

SUFFOLK COUNTY TAX MAP NUMBE

PROPERTY SIZE

0.890a

Non Exempt

ITEM NUMBER

BILL NUMBER

SWIS CODE

SD CODE

SECTION

BLOCK

LOT

SUFFIX

IF THE WORD "ARREARS" IS PRINTED HERE SEE COUNTY TREASURER'S NOTICE ON REVERSE SIDE

PROPERTY DESCRIPTION

EXEMPTION DESCRIPTION

TAX RATE

95.4391

TOTAL TAX VALUE

9,200

TOTAL TAX AMOUNT

PROPERTY LOCATION

PROPERTY CODE

R.S.

1

ONE FAMILY RES

PROPERTY TYPE

TOWN AID

SCHOOL AID

SCHOOL CODE

LAND ASSESSMENT

1,000

TOTAL ASSESSMENT

TAX SERVICE CODE

TAX PAYER CODE

MORTGAGE NUMBER

OWNER AS OF TAXABLE STATUS DATE ON MARCH 1, 2019

472489 472401 035000 0005 025000 0000

Map 6058 Section Block Lot 39

28 N HOLLOW DR

210

TRACI L DAUGS

123 NORTH MOUNTAIN AVE SUITE 1

MONTCLAIR NJ 07042

2019 072521 8,780.42

9,200

TRACI DAUGS GODFREY

2 BROWN RIDGE CT

2018-2019 TAX PAYMENT INFORMATION NOTICE OF ASSESSED VALUE

Interest 1 st ($43.39) 1/25/2019 GAYLE HUFFMAN Payment 1 st $4,338.84 1/25/2019 GAYLE HUFFMAN Payment 1 st $43.39 2/25/2019 TRACI L DAUGS Payment 2 nd $4,338.84 5/29/2019 TRACI L DAUGS

ASSESSED VALUE

Uniform Percentage

FULL VALUE

9,200

.56%

1,642,857

LEVY DESCRIPTION

LEVY %

EXEMPTION CODE

TAXABLE VALUE

TAX RATE PER $1000

RATE CHANGE FROM PRIOR YEAR

TAX AMOUNT

TOTAL TAX AMOUNT

East Hampton School (159)

East Hampton Library

56.38 1.54

9,200 9,200

53.810 1.467

0.59 5.73

4,950.55

134.97

TAX LEVIED

57.92 %

FOR SCHOOL

5,085.52

Suffolk County

3.28

9,200

3.129

0.00

287.90

TAX LEVIED

3.28 %

FOR COUNTY

287.90

General Town Outside Village

East Hampton Airport

Town Highway Outside Village

26.99 4.15

9,200

9,200

9,200

25.760 3.964

2.61

0.00

1.46-

2,369.93

0.00

364.70

TAX LEVIED

31.14 %

FOR TOWN

2,734.63

Out Of County Tuition

Northwest Fire Protection Dist

Recycling & Solid Waste Distri

Scavenger Waste Water

Nys-real-prop-tax-law

MTA TAX

0.08

5.04

1.86

0.58 0.10

9,200

9,200

9,200

9,200

9,200

9,200

0.080

4.806

1.777

0.549 0.097

0.00

0.81-

4.16

0.00

0.00

0.00

7.36

442.13

163.44

0.00

50.52

8.92

TAX LEVIED

7.66 %

FOR OTHER

672.37

FIRST HALF TAX

$4,390.21

SECOND HALF TAX $4,390.21

TOTAL TAX LEVY 8,780.42

DUE DEC.1,2019 PAYABLE WITHOUT PENALTY TO JAN.10,2020.

DUE DEC.1,2019 PAYABLE WITHOUT PENALTY TO MAY 31,2020.

THIS TAX MAY BE PAID IN ONE OR TWO INSTALLMENTS

Back to Property Information

5278

C O PY