Page 1668 - draft

P. 1668

U.S. PUBLIC FINANCE

Appendix C: Assigning Instrument Ratings for K-12 School Districts

In this appendix, we describe our general principles for assessing how an instrument’s particular

characteristics affect its credit risk, more specifically the instrument’s probability of default and loss upon an

event of default. Credit risk of individual debt instruments of school districts and their related units may

24

be different from what is reflected in the issuer rating.

We also provide guidance for assigning individual debt instrument ratings relative to the issuer rating based

25

on these considerations. These differences may arise from the specific pledge included in the instrument’s

terms, the instrument’s priority of claim and the nature of the instrument (i.e., whether it is a contingent or

a non-contingent obligation). As a result, instrument considerations may lead to the application of upward

or downward notches from the issuer rating.

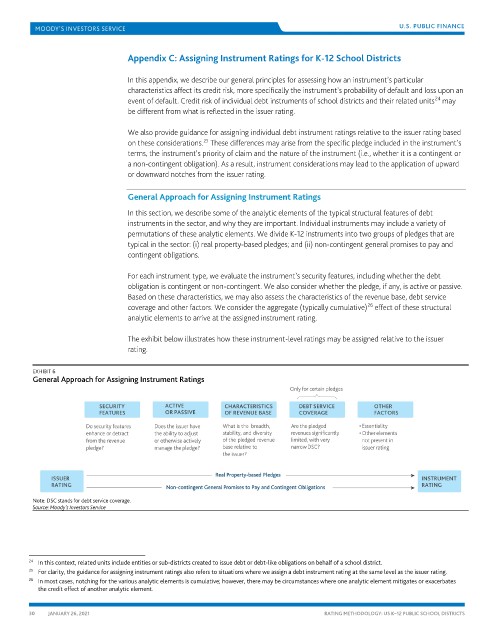

General Approach for Assigning Instrument Ratings

In this section, we describe some of the analytic elements of the typical structural features of debt

instruments in the sector, and why they are important. Individual instruments may include a variety of

permutations of these analytic elements. We divide K-12 instruments into two groups of pledges that are

typical in the sector: (i) real property-based pledges; and (ii) non-contingent general promises to pay and

contingent obligations.

For each instrument type, we evaluate the instrument’s security features, including whether the debt

obligation is contingent or non-contingent. We also consider whether the pledge, if any, is active or passive.

Based on these characteristics, we may also assess the characteristics of the revenue base, debt service

26

coverage and other factors. We consider the aggregate (typically cumulative) effect of these structural

analytic elements to arrive at the assigned instrument rating.

The exhibit below illustrates how these instrument-level ratings may be assigned relative to the issuer

rating.

EXHIBIT 6

General Approach for Assigning Instrument Ratings

Note: DSC stands for debt service coverage.

Source: Moody’s Investors Service

24 In this context, related units include entities or sub-districts created to issue debt or debt-like obligations on behalf of a school district.

25 For clarity, the guidance for assigning instrument ratings also refers to situations where we assign a debt instrument rating at the same level as the issuer rating.

26 In most cases, notching for the various analytic elements is cumulative; however, there may be circumstances where one analytic element mitigates or exacerbates

the credit effect of another analytic element.

30 JANUARY 26, 2021 RATING METHODOLOGY: US K–12 PUBLIC SCHOOL DISTRICTS